Assessing U.S. Financial Regulators Action on Climate Financial Risk

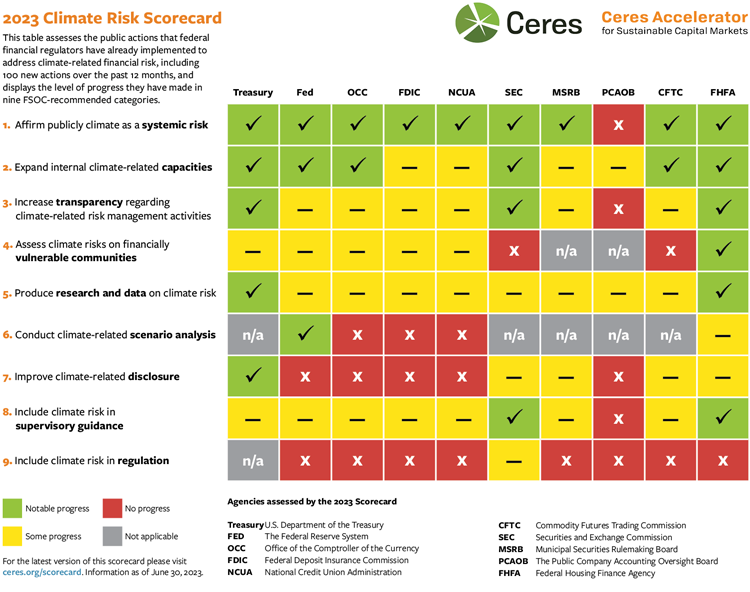

A new scorecard released in July 2023 by the Ceres Accelerator for Sustainable Capital Markets shows how 10 federal financial regulators have implemented key actions to address the financial risks of climate change, growing the total number of actions to more than 100 since July 2022. However, U.S. regulators have much more work to do to address these risks with the same level of ambition and urgency as their global counterparts.

The 2023 Climate Risk Scorecard: Assessing U.S. Financial Regulator Action on Climate Financial Risk found most of the assessed regulators have made meaningful strides in producing research and data on climate risk and incorporating climate risk into their supervision of regulated entities, however urgent action is required to improve climate-related disclosures, increase transparency in climate-related risk management practices, including climate risks within regulatory frameworks, implement climate-related scenario analysis, and assess climate risks on financially vulnerable communities.

Among those assessed include the Federal Reserve Bank (the Fed), the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), the National Credit Union Administration (NCUA), the U.S. Securities and Exchange Commission (SEC), the Municipal Securities Rulemaking Board (MSRB), the Public Company Accounting Oversight Board (PCAOB), the Commodity Futures Trading Commission (CFTC), the Federal Housing Finance Agency (FHFA), and the U.S. Department of the Treasury.

“Climate-related financial risks have placed capital markets and financial institutions in an unparalleled state of vulnerability,” said Steven M. Rothstein, Managing Director of the Ceres Accelerator for Sustainable Capital Markets at Ceres. “The interconnectedness of the U.S. financial system means risk and climate events can trigger cascading crises that undermine the integrity of the entire economy. The sector needs to better integrate climate risk into its supervision of financial entities and put stronger practices in place to assess the consequences of the climate-related scenarios that will arise unless we make systemic changes.”

The analysis uncovered several key findings including:

- More than 100 regulatory actions since July 2022 to address climate-related financial risks, representing a notable shift beyond foundational actions toward implementing climate-related risk management practices in step with global counterparts.

- Nine regulators have publicly affirmed climate as a systemic risk to the financial system, sending a strong signal to the market and public that federal regulators understand that climate risk may adversely impact their regulated entities as well as the broader economy. The Public Company Accounting Oversight Board stands alone in not making this affirmation yet.

- Six of 10 regulators have robust internal climate-related capacities, but this year has seen additional progress from those still developing their staffing and technical expertise.

- All but two regulators improved transparency regarding their actions to measure and manage climate-related financial risks at their regulated entities.

- Minimal public progress was made among regulators with authority that encompasses consideration of financially vulnerable communities.

To better document progress and reflect ongoing regulator commitments and areas of need, Ceres expanded the assessment categories from six to nine, drawing from the 35 recommendations within the Financial Stability Oversight Council’s Report on Climate-Related Financial Risk. The full methodology can be found here.

Regulators were assessed on progress achieved from July 2022 through June 2023 across key categories, using previous years as a baseline, measuring whether each regulator has:

- Publicly affirmed climate as a systemic risk

- Expanded internal climate-related capacities

- Increased transparency regarding climate-related risk management activities

- Assessed climate risks on financially vulnerable communities

- Produced research and data on climate change

- Conducted climate-related scenario analysis

- Improved climate-related disclosure

- Included climate risk in supervisory guidance

- Included climate risk in regulation

The 2023 scorecard is the third of its kind. The 2022 iteration, Assessing U.S. Financial Regulator Action on Climate Financial Risk, assessed nine federal regulators on 6 criteria and identified 230 actions since April 2021 to address climate financial risk.

About Ceres

Ceres is a nonprofit organization working with the most influential capital market leaders to solve the world’s greatest sustainability challenges. The Ceres Accelerator for Sustainable Capital Markets is a center of excellence within Ceres that aims to transform the practices and policies that govern capital markets to reduce the worst financial impacts of the climate crisis. It spurs action on climate change as a systemic financial risk—driving the large-scale behavior and systems change needed to achieve a net-zero emissions economy through key financial actors including investors, banks, and insurers. The Ceres Accelerator also works with corporate boards of directors on improving governance of climate change and other sustainability issues. For more information, visit www.ceres.org and www.ceres.org/accelerator and follow @CeresNews.