This fintech dealmaker wants to restore America’s Great Plains by combining investors, land purchases, regen ag, renewable energy leases and the right boots on the ground.

America’s first great climate crisis was the “dust bowl” of the 1930s, a manmade environmental catastrophe that greatly eroded sections of the Great Plains in the United States. An insufficient understanding of the Plains ecosystem led to extensive deep plowing of 100 million acres of topsoil, displacing the native, deep-rooted grasses that normally trapped soil and moisture during drought and high winds to grow large quantities of wheat to supply World War I.

America’s first great climate crisis was the “dust bowl” of the 1930s, a manmade environmental catastrophe that greatly eroded sections of the Great Plains in the United States. An insufficient understanding of the Plains ecosystem led to extensive deep plowing of 100 million acres of topsoil, displacing the native, deep-rooted grasses that normally trapped soil and moisture during drought and high winds to grow large quantities of wheat to supply World War I.

The deprecation of the land has continued, but entrepreneurs and investors, including Bill Gates, see a growing opportunity to acquire land at a favorable price to generate substantial monetary & cultural value with renewable technology while regenerating the depleted soil.

Tim Luckow is the founder and CEO of the Colorado-based fintech startup Farm Holdings, which provides a flexible investment platform at the intersection of land restoration, regenerative agriculture, and clean energy production.

Veteran Silicon Valley investor and entrepreneur Brian Zisk spoke to him recently to find out more.

Key points:

- Farm’s projects are designed to match accredited investors with seasoned farmers and ranchers who want to expand and improve farmland to make a positive climate impact. Farm sets up investment deals through SPVs and earns its revenue by charging a fee.

- One key to project success is undertaking initiatives projects is to co-locate clean energy development with grazing or farming operations.

Brian Zisk: Hi Tim. Thank you for taking the time to chat. Please tell us what you’re doing at Farm and why?

Tim Luckow: I started Farm out of an effort to try to restore as much land as possible and soon became obsessed with soil and soil erosion. We’re learning a lot about what you need to do to make regenerative agriculture work financially for investors, including partnering with farmers and ranchers around the collocation of clean energy with regenerative agriculture.

Brian: Are you the first to do this?

Tim: While we are not the first to address these issues, I think we’re doing it in a slightly different way.

Our model depends on partnering with great farmers and ranchers looking to expand, which I think is relatively unique to Farm Holdings right now. There are a lot of transition funds in agriculture saying, “You’re going from conventional agriculture to organic or regenerative agriculture, and we can help you with a three to five-year funding plan to get through that transition.

Brian: Please tell me about your deal structures. It’s not exactly a fund. Is it more like a series of investment syndicates?

Tim: We think of Farm as a platform.

At this point, we’re doing Special Purpose Vehicles (SPVs) for specific deals for accredited investors. We’re building a track record of doing individual projects with individual operators. We are working to do multiple projects with each partner. So, when we do a project with somebody like Breadtree Chestnut Farms out in New York, it’s not just to do one project. It’s to expand with them for years to come.

On the other side, we’re building our investor network, and we’ve got a little bit over $100 million in expressed demand, mostly just through word of mouth, which is very exciting as it shows that the demand is there and that now it’s an execution game. We need to ensure that the projects we bring to investors are sufficiently attractive.

Brian: How much capital have you deployed to this point?

Tim: We’re just launching our first accredited projects right now.

We did a small parcel in southern Colorado early last year. We’re just now going out with one for Breadtree Farms, which is a $650,000 offering to expand their chestnut farms in New York. Next will be one with a group called Ranchlands, a $7 million offering for the 80,000-acre Paint Rock Canyon Ranch in Wyoming. We have about 10 projects in the works. These types of projects take a while to pull together but we’re moving faster with each one. As a startup, it’s all about finding the right people and projects to partner with and convincing them, and then figuring out how we do this better and more efficiently.

It’s not a pure carbon play by any means nor a pure real estate play. Farm is an ecosystem play as new markets come online, such as biodiversity credits, ecosystem services, and business lines like that.

Brian: What are you looking for in a partner? What are the parameters that would allow you to work with them?

Tim: The first is a strong track record on the operator side.

Many of these folks have over a decade of working in the space with these practices. We’re looking for leaders in their local community, folks who employ many people in that community. folks who have gotten creative to survive over multiple decades. We’re interested in people aligned with our vision who want to restore landscapes, not just looking for a perfect ranch in perfect condition.

Brian: How about carbon credits? Are they substantial enough to significantly affect the finances of your projects?

Tim: We think of carbon credits as an additional revenue stream rather than a primary one.

We have looked at many carbon projects on their own and as parts of other projects and couldn’t make the numbers work where carbon was the primary revenue stream.

From an investor standpoint, it is tough as there are a lot of assumptions and very long timelines, especially not knowing the value of carbon credits far down the road.

Brian: So where does the additional revenue come from?

Tim: While we’re looking at projects where the primary revenue stream tends to be lease payments and revenue shares from an agricultural operation, we’re even more interested in energy leases.

A clean energy lease from a wind or solar developer can be 10x the price of an agricultural lease.

Farm’s original idea was to go buy large swaths of land and co-locate clean energy with regenerative agriculture, and what we’ve found working with agricultural operators is they are extremely open to that. Something similar has already happened historically multiple times, during the oil and gas booms, etc. Drive around Colorado, where I live now, and you’ll see oil and gas rigs on the corner of farmland most of the time.

Brian: When people invest, they want the best financial return. Do you project competitive financial returns, or are people backing Farm projects more for the additional environmental benefits?

Tim: While much of our investor community comes from an environmental standpoint, we care deeply about making the returns competitive.

We target 8%+ on our projects. With land appreciation and joint ventures, we believe we can get there. Other platforms in this space have pretty significantly outperformed their target returns. That is our hope over time, for regenerative agriculture to be a good investment, especially if you have an ownership stake in the land.

Brian: Does this investment require taking a new look at how you value land?

Tim: Yes. There are misaligned incentives at this point.

We are working on deal models where our operating partner has equity in the land, which will be important over time. Overgrazing is the classic example of where you lose value in these sorts of projects. When you’ve got a land manager with no equity stake in the land, and their entire livelihood depends on the weight of their cows, they have the cows eat as much grass as possible. They’re not thinking about the value of the land. They’re just thinking, “How will I feed my family this year”? As soon as they have a stake in the land value, it becomes a question, “is it worth me grazing that portion of land beyond this point? Is the value of keeping the land healthy worth more than that?” I believe this dynamic is underrated right now. Once folks understand and share part of the upside, it becomes an expansion game.

Brian: What do you charge for managing the investment?

Tim: We’re basically doing a percentage of invested capital and an annual management and reporting fee.

We’re justifying the 1% annual fee by planning to do a lot of work around natural reporting in addition to financial reporting. That’s part of where the impact angle comes back in. It’s going to be really interesting to see as concepts like natural capital grow. We want to be in that space. We want to work with natural capital firms and models, and there’s a lot of untapped value in the land and these landscapes when you apply that lens.

Brian: How do you balance the factors? For instance, this seems like it would be a very advantageous model for solar farms, but from my understanding, they basically strip-mine the land.

Tim: That definitely happens sometimes, though not always.

Some concepts like Agravoltaic are growing in the West right now, where you’re grazing sheep or goats around solar. They’re showing that if you do solar panels a little bit higher, you can actually provide shade and run cattle under them.

Brian: Do you share practices regarding how people can best manage land?

Tim: Regenerative practices need more of a megaphone than secrecy.

A lot of them are known, and a lot of them are hard to implement. It’s hard to manage the landscape properly, and there are a lot of variables. There are a lot of ways that things can backfire. The aim is to build a land network and then enable younger farmers to access to the land network without risking an entire project.

Brian: What do you find most interesting that I haven’t asked? Is there anything that you’d love to try to get across about what you’re doing?

Tim: A land network that can be optimized over time will be incredibly valuable.

There’s so much complexity, and every landscape has differences. Once you’re gathering data continuously and seeing what works and what doesn’t, and what works together, you can make better use of it. Hundreds of millions of acres have zero- or one-use today that could be repurposed with a better climate and soil and biodiversity perspective.

The Value of Partnership. Beyond just the land, I get really excited about partners enabling each other. We’ve had an agro-forestry group benefitting from having cattle and bison ranchers in the network because then they can plant trees on that range land. They can’t justify an entire project based on this alone, but this is a nice little additional revenue stream. There can be a carbon revenue stream, and some can add shade and value to the property.

We have a variety of solar developers who are enabled by access to the grassland’s acreage. What gets really interesting is called behind-the-meter use. It sets up the opportunity for another lease next to an energy project and to use that electricity before it hits the grid. It could be an indoor farm, crops or crypto. You could charge your electric tractors.

Brian: What’s gating Farm from massive success? What would you do if you could blow through one thing that was blocking you?

Tim: It would make it easier for anybody to invest in these projects.

We’re currently offering under the 506c JOBS Act, and that’s why I can talk about some of this stuff. My dream for Farm is that anybody can use it like a stock trading app and invest in these projects. All of a sudden, you are looking at your land and natural capital values next to stocks and assets like that, and regenerative land is an asset class that should be in that group.

Article by Brian Zisk, who is a seed investor in and advisor to Chia Network, the eco-friendly cryptocurrency of the future being developed by Bram Cohen. He was the Head of Market Development for Chia Network prior to the network launch. Brian is a founder of BuzzMakers, Inc., which has produced 19 SF MusicTech Summits, 7 Future of Money & Technology Summits, and the Maui MusicTech Experiment. He is a co-founder of the SF MusicTech Fund. Additionally, Brian is a Board Member Emiritus and Co-Founder and of the Future of Music Coalition and has been a Board Member and/or Strategic Advisor for a wide variety of tech companies and non-profits.

Article reprinted with Permission as part of GreenMoney’s ongoing collaboration with Climate and Capital Media.

In support of the transition to a low-carbon economy, Parnassus Investments, a pioneer in responsible investing, is removing its long-held exclusion on companies that make more than 10% of their revenue from nuclear power generation and/or related activities.

In support of the transition to a low-carbon economy, Parnassus Investments, a pioneer in responsible investing, is removing its long-held exclusion on companies that make more than 10% of their revenue from nuclear power generation and/or related activities.

The Croatan Institute recently released a report,

The Croatan Institute recently released a report,

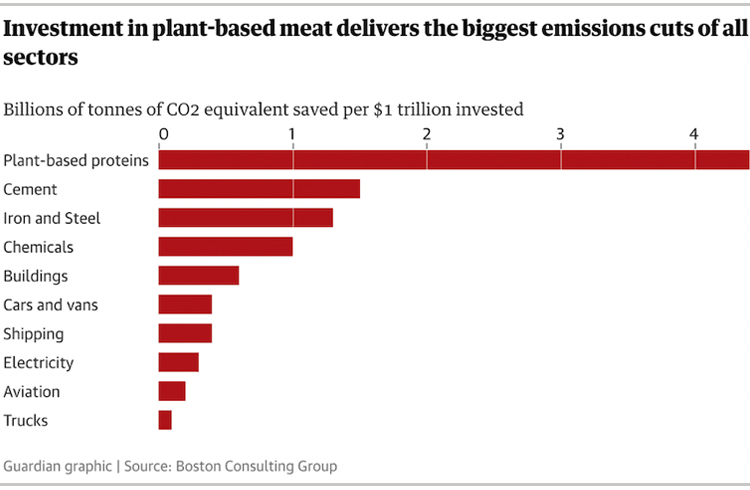

Climate change is one of the biggest threats facing our planet today. With greenhouse gas emissions continuing to rise, it is imperative that we find innovative solutions to reduce emissions and mitigate the impacts of climate change. One promising solution is the development of alternative proteins, which could offer a significant and untapped opportunity for climate financing.

Climate change is one of the biggest threats facing our planet today. With greenhouse gas emissions continuing to rise, it is imperative that we find innovative solutions to reduce emissions and mitigate the impacts of climate change. One promising solution is the development of alternative proteins, which could offer a significant and untapped opportunity for climate financing.

At first glance, investment in the meat and dairy industry looks attractive. Global meat consumption is expected to grow over the next decade to a projected increase of 14% by 2030,

At first glance, investment in the meat and dairy industry looks attractive. Global meat consumption is expected to grow over the next decade to a projected increase of 14% by 2030,

Blueberries at Burns Farms, Planting Phase 2

Blueberries at Burns Farms, Planting Phase 2

Trillium’s Sustainable Opportunities thematic suite of public equity strategies aims to address global sustainability challenges in three core areas: climate solutions, economic inclusion, and healthy living. Since 2008, Sustainable Opportunities has looked to identify companies benefiting from the shift to a more sustainable economy. As an intersecting theme, sustainable food and agriculture cuts across these issues, and yet it is a difficult theme to play in public equities.

Trillium’s Sustainable Opportunities thematic suite of public equity strategies aims to address global sustainability challenges in three core areas: climate solutions, economic inclusion, and healthy living. Since 2008, Sustainable Opportunities has looked to identify companies benefiting from the shift to a more sustainable economy. As an intersecting theme, sustainable food and agriculture cuts across these issues, and yet it is a difficult theme to play in public equities.

Reduced carbon intensity

Reduced carbon intensity