Aquaculture: Bringing Climate Resilience to Maine’s Blue Economy

Adapting to and combating climate change through aquaculture investment

Maine, with nearly 3,400 miles of coastline and over 2,000 coastal islands, is inextricably tied to the sea. The Gulf of Maine has long supplied Mainers with both livelihoods and food but is one of the fastest warming bodies of water on the globe, with the average temperature rising by four degrees Fahrenheit over last four decades1.

Maine, with nearly 3,400 miles of coastline and over 2,000 coastal islands, is inextricably tied to the sea. The Gulf of Maine has long supplied Mainers with both livelihoods and food but is one of the fastest warming bodies of water on the globe, with the average temperature rising by four degrees Fahrenheit over last four decades1.

At three and a half times faster than the global average, the change is enough to materially affect people’s dinner plates and paychecks.

And it’s not just the changing climate: Maine’s working waterfront is seemingly being squeezed on all sides, with high costs for bait and fuel, loss of working waterfront access to development, ongoing uncertainty regarding regulatory demands for ropeless gear, and worries about the impact of offshore wind on already vulnerable fisheries.

The overall annual impact of Maine’s fisheries (or Maine’s “Blue Economy”) is an estimated $3.2 billion and 33,300 jobs.2 That’s economic input and jobs Maine can’t afford to lose – particularly in Downeast Maine, where the sector accounts for 45% of all direct jobs.3

For Coastal Enterprises, Inc. (CEI), a community development financial institution (CDFI) based in Brunswick, Maine, investing in aquaculture supports community economic development by diversifying income streams along the rural coastline. It builds climate resilience while helping to ensure that families that have worked Maine’s waters for generations can have opportunities to do so for generations to come, while also welcoming a new crop of sea farmers to the coast.

This interview took place in July 2023. In this interview, Cameron Barner discusses his path to small business ownership, along with Love Point Oyster’s story and where CEI fits into the picture.

The Small Business: Love Point Oysters

Try telling a banker that your first crop will take three years to harvest, that their collateral will literally be in or underwater, and sales profitability is several years away. That’s the challenge many oyster farmers face when trying to get startup capital.

It was one faced by Cameron Barner of Love Point Oysters, when he realized that the company had outgrown their small skiff and would need to purchase an additional boat. “Aquaculture is a risky business, so traditional banks don’t always take you seriously; they have hard lines where they won’t lend.” Barner turned instead to CEI’s Sea Farm Loan. “We didn’t have the capital to go buy a new boat outright, so we reached out to CEI.”

CEI has over 45 years of experience working with marine-based businesses, with full time fisheries and aquaculture experts providing technical assistance and business advisors who have developed accurate and detailed financial forecasting models for the industry. From experience they understood the risks and potential of these businesses and provide not only a loan, but one designed specifically to meet the needs of Maine’s working waterfront, with a low-interest rate and seasonal payment schedules that help marine businesses thrive and reduce the burden of carrying debt. This kind of tailored product is made possible through long-term, flexible low and no-cost philanthropic and government funding raised by CEI, which then passes along those reduced costs and flexibility to the borrower.

Working with a community development financial institution has additional benefits beyond access to capital, as CEI was able to connect Barner with a business advisor and sector experts at no-cost. “That relationship was just so positive, we worked with our loan officer and after that we got connected with the Maine Small Business Development Center at CEI. It just really helped us kick start our business into the next phase and thinking about different opportunities.”

“Oyster is a virtuous protein.” says Barnes. “It’s a creature that gives so much and takes nothing in return. It really has little to no negative impact on the environment and it’s pretty much only positive in terms of water quality. Growing oysters is good.”

Thanks to the investment in equipment, plus advising, Love Point is growing, with goals to increase distribution beyond southern Maine, which is good for business and the environment.

Working Waterfront Access for the Industry: Sea Meadow Marine Foundation

Currently, only 20 miles of Maine’s coast remain as commercial working waterfronts, particularly as residential developments displace traditional uses. Many fishermen and aquaculturists have limited access to vital wharf infrastructure, including tidal access, commercial hoists, forklifts, and room to load and maneuver trucks4 – making it all the harder and more expensive to maintain a business.

On a statewide basis, the Maine Working Waterfront Access Protection Program provides a channel for preserving working waterfront properties. Established by the Maine legislature in 2005, with significant advocacy from CEI, this bond-funded program allows the state to buy development rights on a piece of working waterfront to ensure future development will not limit commercial marine use. The program has preserved 34 properties to date, but ongoing funding is dependent on passing new bonds every 2-3 years, and the application process is competitive – meaning that while it’s an incredibly important tool, it doesn’t work in all situations.

The Even Keel Boatyard and Marina in Yarmouth, Maine is a notable exception to the trend of lost access. In 2020, the 12-acre boatyard, with 7 acres of salt marsh and 4 acres of land, went up for sale for $1.26 million. The owners didn’t want to sell to developers, but none of the businesses currently using the boatyard had the funds to make the purchase. Led by local dock builder Chad Strater, a group of marine professionals banded together to form the nonprofit Sea Meadow Marine Foundation, with the goal of preserving the Even Keel boatyard and other working waterfront properties.

“The working waterfront is a critical aspect of Maine’s economy and environmental health,” affirms Strater, “It’s part of our economy and part of our lifestyle. If the working waterfront goes away, it’s not coming back.”

Sea Meadow was able to purchase the Even Keel property in December 2021. Again, a combination of government and philanthropic dollars made the enterprise possible, including a U.S. Department of Agriculture Community Facilities loan from Coastal Enterprises Inc. and an operating grant from the Elmina B. Sewall Foundation in Maine.

Now Sea Meadow Marine, as the property was renamed, host a variety of marine-based businesses including a business hub for early-stage fisheries and sustainable aquaculture businesses alongside marina services, heritage boat builders, and recreational marine organizations, including Love Point Oysters; the US Northeast division of Net Your Problem, a nonprofit that recycles used fishing gear; and the Boatyard, a boat equipment retailer/service provider co-owned by Statler and Sea Meadow’s Board Secretary Nick Planson, that has a goal to help to convert local aquaculture, harvesting and fishing operations to 100% electric power.

Financing a More Resilient Future

The financing packages for Love Point Oysters and Sea Meadow both required funding from impact investors, public, and philanthropic sources to make them workable. Even while motivated entrepreneurs like Barner and Strater look ways to build more resilient and climate-friendly businesses, new equipment, particularly more ocean-friendly equipment like electric engines are expensive and pressure from developers remains high. Fisheries, at their core, are a commodity-based industry, with fluctuating dock prices that make traditional debt at market rates hard to plan for and to bear. Grants combined with low-cost climate-motivated investments from individuals and foundations allow CEI, and other mission-based funders, the ability to make capital accessible and affordable to those entrepreneurs shifting the tide to a more resilient and sustainable working waterfront – a model that is working for Maine and can be replicated in communities along every coast.

The financing packages for Love Point Oysters and Sea Meadow both required funding from impact investors, public, and philanthropic sources to make them workable. Even while motivated entrepreneurs like Barner and Strater look ways to build more resilient and climate-friendly businesses, new equipment, particularly more ocean-friendly equipment like electric engines are expensive and pressure from developers remains high. Fisheries, at their core, are a commodity-based industry, with fluctuating dock prices that make traditional debt at market rates hard to plan for and to bear. Grants combined with low-cost climate-motivated investments from individuals and foundations allow CEI, and other mission-based funders, the ability to make capital accessible and affordable to those entrepreneurs shifting the tide to a more resilient and sustainable working waterfront – a model that is working for Maine and can be replicated in communities along every coast.

Article by Nick Branchina, Director of Fisheries and Aquaculture at CEI; and Hugh Cowperthwaite, Senior Program Director of Fisheries and Aquaculture at CEI

1 Ocean warming is ‘off the charts’ this summer. But not in the Gulf of Maine. Why? | WBUR News

2 FINAL-SEAMaine-Economic-Impact-Analysis-Report-2.pdf

3 ibid

4 WWF-Report_web.pdf (islandinstitute.org)

Energy & Climate, Featured Articles, Food & Farming, Impact Investing, Sustainable Business

Trillium’s Sustainable Opportunities thematic public equity strategy aims to address global sustainability challenges in three core areas: climate solutions, economic inclusion, and healthy living. While many of Trillium’s equity strategies have exposure to renewable energy, the Sustainable Opportunities strategy has a more specific, thematic focus, and generally a greater level of exposure to companies benefiting from the shift to a more sustainable economy. Within climate solutions, a primary focus is renewable energy and energy conservation, particularly exposure to companies involved in:

Trillium’s Sustainable Opportunities thematic public equity strategy aims to address global sustainability challenges in three core areas: climate solutions, economic inclusion, and healthy living. While many of Trillium’s equity strategies have exposure to renewable energy, the Sustainable Opportunities strategy has a more specific, thematic focus, and generally a greater level of exposure to companies benefiting from the shift to a more sustainable economy. Within climate solutions, a primary focus is renewable energy and energy conservation, particularly exposure to companies involved in:

For investors concerned about climate change risk, the issue of which stocks to buy, hold and sell can be quite complicated. The power sector representing the largest consumer of carbon fuels is highly regulated. When plants are decommissioned, rates are typically raised to cover the cost of investment in replacement plants and equipment. Investors must understand the risks to a company that might end up with a stranded asset. When there is adequate cost recovery, it represents a cost to users, but it’s often a benefit to shareholders. The tension for regulators is striking the right balance.

For investors concerned about climate change risk, the issue of which stocks to buy, hold and sell can be quite complicated. The power sector representing the largest consumer of carbon fuels is highly regulated. When plants are decommissioned, rates are typically raised to cover the cost of investment in replacement plants and equipment. Investors must understand the risks to a company that might end up with a stranded asset. When there is adequate cost recovery, it represents a cost to users, but it’s often a benefit to shareholders. The tension for regulators is striking the right balance.

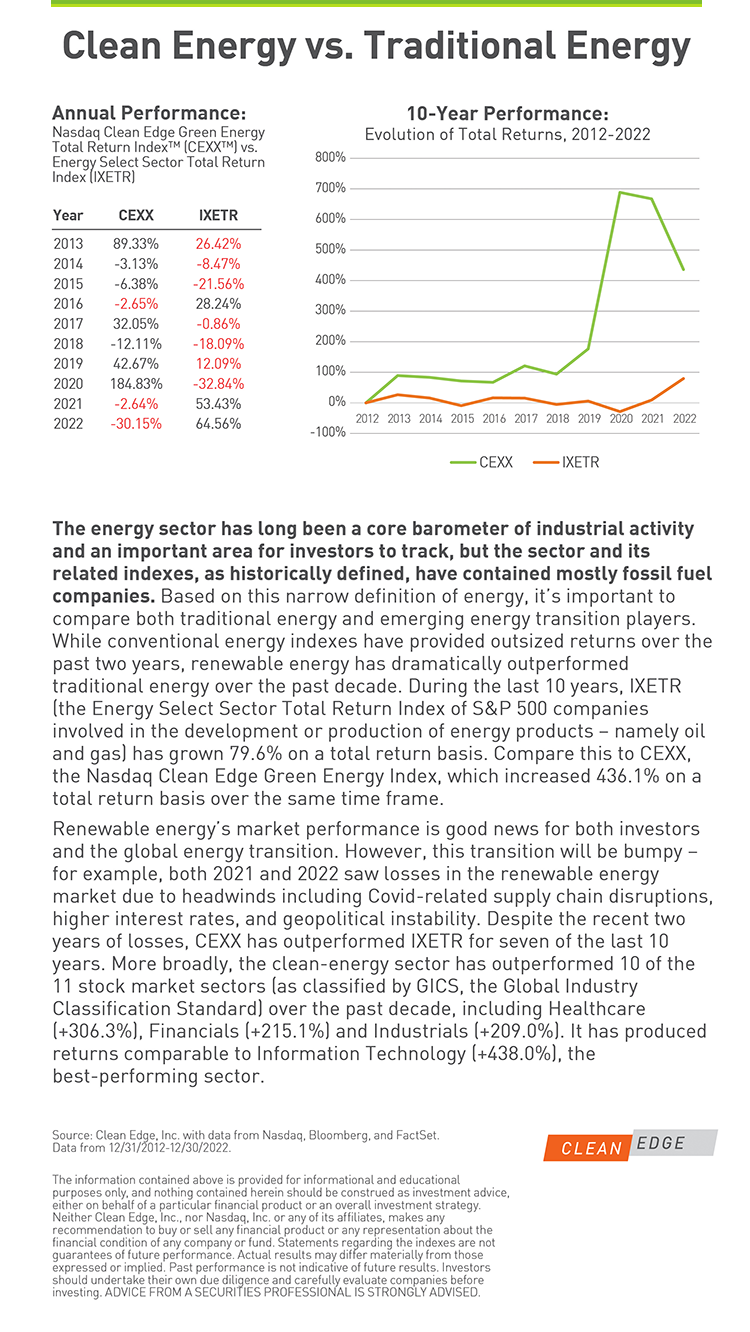

As someone who has been researching clean-tech sectors for more than two decades and conducting stock index research since 2006, I find it exciting to be tracking the mass adoption and scale-up progress of a range of clean technologies, from solar power and energy storage to electric vehicles and transmission infrastructure.

As someone who has been researching clean-tech sectors for more than two decades and conducting stock index research since 2006, I find it exciting to be tracking the mass adoption and scale-up progress of a range of clean technologies, from solar power and energy storage to electric vehicles and transmission infrastructure.

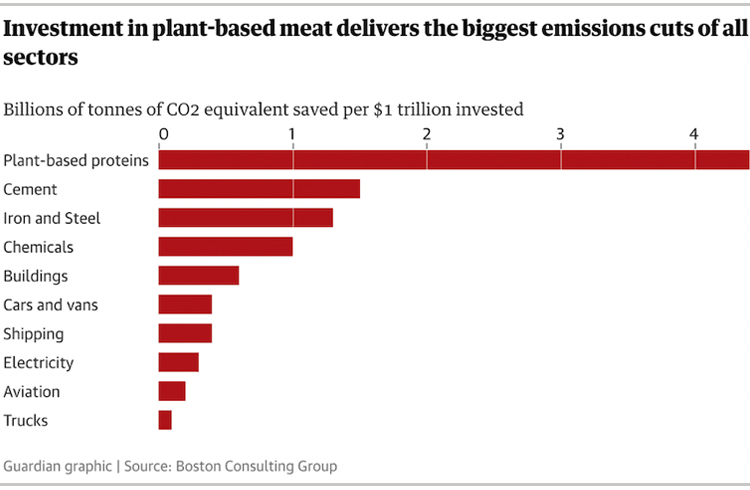

Climate change is one of the biggest threats facing our planet today. With greenhouse gas emissions continuing to rise, it is imperative that we find innovative solutions to reduce emissions and mitigate the impacts of climate change. One promising solution is the development of alternative proteins, which could offer a significant and untapped opportunity for climate financing.

Climate change is one of the biggest threats facing our planet today. With greenhouse gas emissions continuing to rise, it is imperative that we find innovative solutions to reduce emissions and mitigate the impacts of climate change. One promising solution is the development of alternative proteins, which could offer a significant and untapped opportunity for climate financing.

At first glance, investment in the meat and dairy industry looks attractive. Global meat consumption is expected to grow over the next decade to a projected increase of 14% by 2030,

At first glance, investment in the meat and dairy industry looks attractive. Global meat consumption is expected to grow over the next decade to a projected increase of 14% by 2030,

Blueberries at Burns Farms, Planting Phase 2

Blueberries at Burns Farms, Planting Phase 2