Proof of Peak Natural Gas but Climate Innovation Funding is Still Challenging

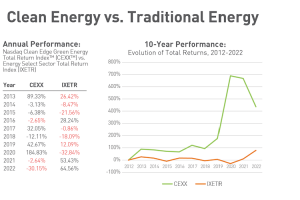

We’re using a record amount of electricity here on Earth but while emissions are up, the energy mix is changing significantly. Indeed, wind and solar were up 19% year-on-year from 2021, whereas coal was up just 1.1% and natural gas use actually plateaued. As a result, the energy we use now has the lowest carbon emissions ever.