Valuing Water Finance Initiative Benchmark report highlights how companies’ water management practices have improved and fallen short.

Ceres’ latest benchmark of corporate water stewardship shows how companies from four water-intensive industries — food, beverage, apparel, and high-tech — have responded to mounting financial, regulatory, and reputational risks tied to their water use and impacts.

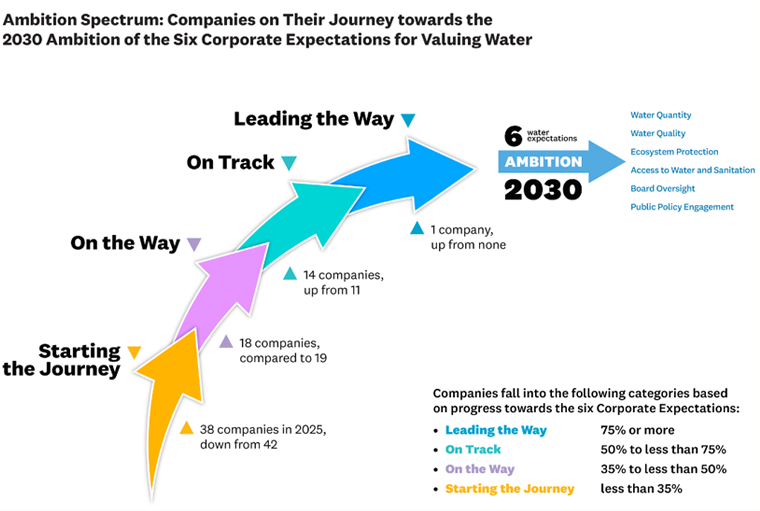

Coming two years after the first assessment, the new report shows that while companies have made progress — 48 of the 71 focus companies improved their scores — it is uneven and not happening quickly enough, nor at the scale needed to meet escalating water challenges. By 2050, more than 30% of global GDP is expected to be exposed to water stress.

“Pressure on water resources, from extreme weather to population growth to industry demand, is at an all-time high,” said Shama Perveen, director of water research at Ceres and report co-author. “This report underscores that companies and investors need to move swiftly to secure long-term value and protect freshwater resources essential to ecosystems and communities where they operate and source from.”

The benchmark evaluates company performance against six Corporate Expectations for Valuing Water, a set of goals for 2030 aimed at minimizing impacts on freshwater resources and strengthening ecosystem and business resilience. These expectations guide the Valuing Water Finance Initiative, the only investor-led global effort focused on water action.

The report, developed in partnership with Quantis using publicly available company disclosures, provides critical insights into companies’ vulnerabilities, opportunities, and strengths when it comes to managing water. Though results vary across companies and industries, notable trends have emerged, including:

• Companies continue to focus on water availability: 83% of the 71 assessed companies have water use targets, but only half have targets that consider the local conditions of high-risk areas in their value chains.

• Corporate action on water quality remains limited: 41% of the companies have targets to reduce pollution, and few have targets that consider the local conditions of high-risk areas. Most of the companies report the amount of water they withdraw, and wastewater discharged, in operations and/or supply chains, but not how this impacts water availability and quality where it’s happening.

• Companies are engaging more in ecosystem protection or restoration projects with benefits to freshwater but lack goals to ensure progress.

• Most companies have yet to embed WASH (access to water, sanitation, and hygiene) into corporate strategies.

• Companies are improving board oversight of water risk: 73% of companies have formal board and senior management oversight over water-related issues, and half have incentives linked to water.

• Companies have yet to ensure collective action initiatives directly support water goals: just over 40% of the companies with water use targets participate in collective action to help achieve that goal. Even fewer are doing so for water quality.