Clean Energy Investment and Innovation Trends: Navigating the Road Ahead

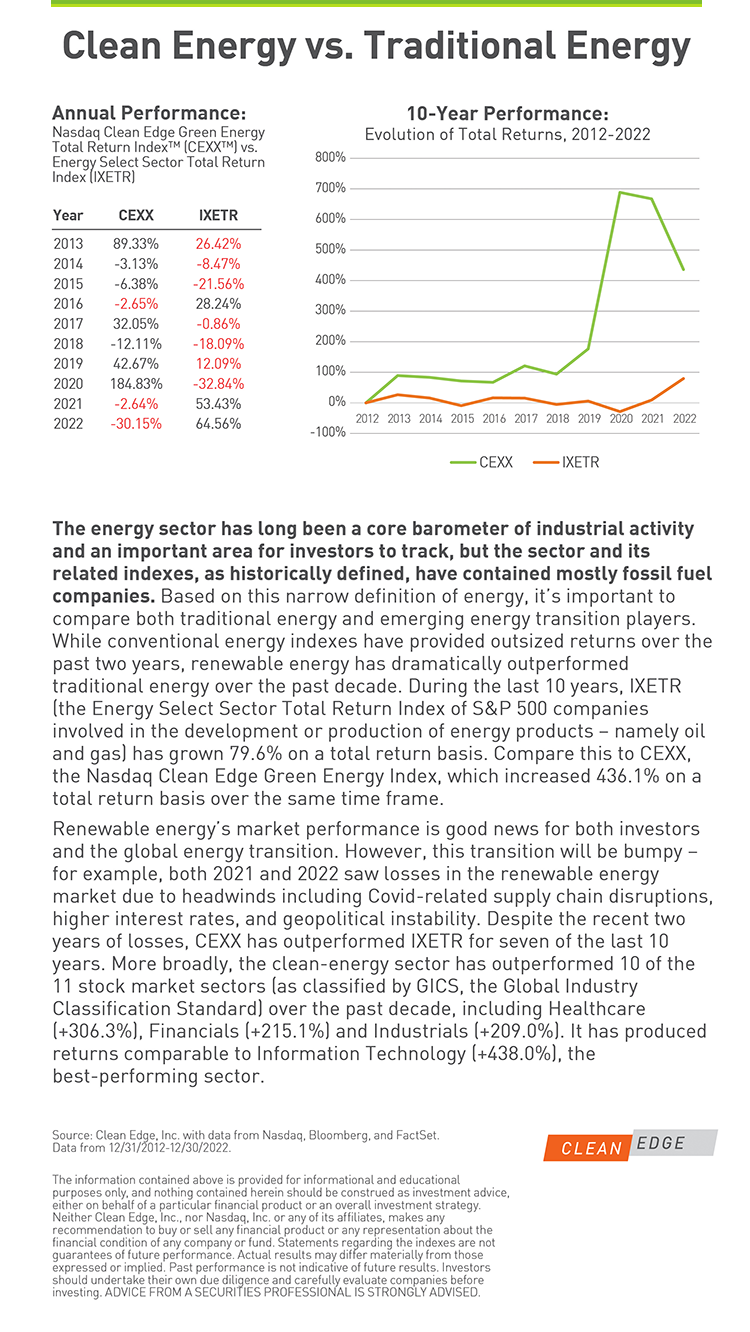

(See more information about the above 10-year performance chart below)

As someone who has been researching clean-tech sectors for more than two decades and conducting stock index research since 2006, I find it exciting to be tracking the mass adoption and scale-up progress of a range of clean technologies, from solar power and energy storage to electric vehicles and transmission infrastructure.

As someone who has been researching clean-tech sectors for more than two decades and conducting stock index research since 2006, I find it exciting to be tracking the mass adoption and scale-up progress of a range of clean technologies, from solar power and energy storage to electric vehicles and transmission infrastructure.

Numerous factors are driving the shift from fossil fuels to clean energy, but two stand out: low-cost renewables (utility-scale solar and onshore wind are now the most price-competitive forms of new electricity capacity additions in most regions) and supportive energy and climate policies (with China’s Five-Year Plans, the U.S.’s Inflation Reduction Act, and Europe’s REPowerEU initiative leading the way). Clean energy has been scaling significantly for the past decade, but recent developments are driving a new wave of investments and deployment.

Some Key Facts and Figures:

- Energy transition investments globally hit $1.1 trillion in 2022, breaking the $1 trillion mark for the first time, according to BloombergNEF. And a projected $1.7 trillion will be investing globally in clean energy in 2023, significantly more than the approximately $1 trillion expected to flow into fossil fuels, according to International Energy Agency.

- Onshore wind and solar are not only the cheapest forms of new power capacity additions globally, but the fastest to deploy. New nuclear, on the other hand, is currently both the most expensive and slowest to deploy.

- Power markets are reaching a tipping point, with most new additions globally coming from solar and wind. A record 83 percent of all new electricity capacity additions came from renewables last year, according to the International Renewable Energy Agency (IRENA).

- All these new installations are having a significant impact. By 2025, more than a third of all global electricity production will come from renewables, according to the International Energy Agency (IEA), surpassing all generation from coal. Globally, solar and wind already outpace generation from nuclear power.

- Eleven states now garner at least 30 percent of their in-state generation from solar and wind. Iowa and South Dakota, the two leaders, generated more than half their electricity from renewables, mainly wind power, in 2022. Iowa surpassed 60 percent for the first time, a new record in the U.S. In California, solar (utility-scale and distributed) contributed 27.3 percent of the state’s total in-state generation; solar now competes with wind as a major generation source in an increasing number of regions.

- As governments and consumers look to wean themselves off Russian natural gas in the wake of Russia’s attack on Ukraine, sales of heat pumps have skyrocketed in Europe, with nearly 3 million units sold in 2022, up around 40 percent from sales in 2021.

- Electric vehicle sales worldwide are projected to increase 35 percent this year, up from approximately 10 million sold in 2022 to 14 million in 2023, according to the IEA. If these projections hold, EV sales will equal approximately 18 percent of total car sales this year, up from just 4 percent three years ago.

There are many other examples of the shift to clean tech – all shining a light on the massive transition that is underway.

7-Point Energy Transition Action Plan

We estimate that the world is approximately halfway through the modern energy transition (2000—2050). Targeted technology, policy, and capital innovations must be deployed at scale and overcome a host of challenges to meet this monumental shift. Indeed, the transition will be bumpy and face several not-so-insignificant headwinds. These include inflationary pressures, material supply constraints and shortages, and incumbent industry misinformation campaigns and pushback. The following, is Clean Edge’s 7-Point Energy Transition Action Plan, which highlights some of the key steps and actions we believe are needed to ensure orderly and sustained progress:

1) Focus on Efficiency – Pursue energy efficiency’s low-hanging fruit for the most bang-for-your-buck, including LEDs, insulation materials, building controls, and energy management systems.

2) Scale Up Wind & Solar Massively – Support aggressive global deployment of solar and wind power, utility-scale and distributed, to reach 100 percent zero-carbon emission electric grids.

3) Pair Renewables with Storage at Scale – Deploy storage at scale to enable 100 percent, 24/7 renewable power. Focus on both utility-scale and distributed storage, using electrochemical batteries (lithium-ion, solid-state, flow, etc.) and mechanical energy storage (pumped hydro, compressed air, etc.).

4) Electrify Heating & Vehicles ASAP – Although we often hear the demand to “electrify everything,” we recommend focusing on two high-impact areas: passenger vehicles (two-, three-, and four-wheelers) and heating and cooling systems for homes and buildings (via adoption of electric heat pumps.)

5) Modernize Transmission & Distribution Grids – Build out a range of electricity grid modernization efforts including digitization, smart meters and devices, bi-directional meters and charging, smart substations, and high-voltage, direct-current transmission lines. A modern 21st century grid is critical to enable the clean-energy transition.

6) Develop Green Hydrogen, Ammonia, and Fuels for Agriculture, Heavy Industry, and Long-Haul Transport – Decarbonizing heavy industry will not be easy and will require green fuels above and beyond electrification. We recommend the adoption of green hydrogen and fuels to support the production of steel, fertilizer, and other energy-intensive industries, as well as for long-haul transport such as trucking, marine shipping, and air travel.

7) Secure Sustainably Mined and Recycled Materials – Ensure the availability of mined and recycled materials for EV, solar, wind, and other clean-energy technology production. The future of energy depends on secure and reliable supplies of sustainably mined or recycled materials (lithium, cobalt, rare earths, silicon, nickel, etc.) rather than the extraction of fossil fuels (coal, oil, gas).

For renewable energy analysts and market participants, the promise of technology-driven renewable energy sources over fossil fuels has become increasingly clear. Extractive energy sources, by their very nature as commodities, exhibit price volatility when pitted against maturing tech-centric clean energy sectors – with their inherent cost-reducing learning curves. But while solar and wind are now among the most cost-effective sources of new electricity capacity additions, we’ll need to see similar cost reductions for EVs, energy storage, alternative conductive materials, electrolyzers, and other electrification technologies over the coming decade. We’ll also need to see cost declines for the grid integration of these technologies (connecting an offshore wind farm to the grid, for example, and getting the electricity to nearby and/or distant customers) – and for deployment obstacles to be removed or streamlined. Achieving the energy transition won’t be easy, but over time it promises lower costs, limited or zero emissions, and if done right, greatly diminished geopolitical volatility.

Article by Ron Pernick, cofounder and managing director of Clean Edge, Inc., where he oversees the development and production of the firm’s thematic research tracking clean energy, transportation, water, and the grid. The company is a joint developer of and contributor to the Nasdaq Clean Edge Green Energy™ Index (CELS™), launched in partnership with Nasdaq in 2006. Other indexes include the Nasdaq OMX Clean Edge Smart Grid Infrastructure™ Index (QGRD™), ISE Clean Edge Water™ Index (HHO™), and the ISE Clean Edge Global Wind Energy™ Index (GWE™). All tracking financial products of Nasdaq Clean Edge indexes exceeded $4 billion in assets under management as of June 23, 2023.

Under his leadership, Clean Edge has been at the forefront of researching technology, capital, and policy innovations driving the energy transition and sustainable infrastructure markets for more than two decades. He is the co-author of two books on clean-tech business and innovation, Clean Tech Nation (HarperCollins, 2012) and The Clean Tech Revolution (HarperCollins, 2007), which was translated into six languages and sold more than 30,000 copies worldwide. He has taught MBA-level courses at Portland State University and New College and is a regular speaker at industry events.

Energy & Climate, Featured Articles, Impact Investing, Sustainable Business

Clean Energy Investment and Innovation Trends – Outlook First

[…] Read Ron’s full article including his 7-Point Energy Transition Action Plan, all here – https://greenmoney.com/clean-energy-investment-and-innovation-trends-navigating-the-road-ahead/ […]