“We shape our buildings, thereafter they shape us” – Churchill

Why Invest for Sustainability in Real Estate?

At Vert Asset Management, our mission is to ‘make sustainable investing easier’. We believe investor choices help shape the world. When more assets are invested for sustainability, more companies will respond with better stewardship and responsibility. When we asked financial advisors how we could make sustainable investing easier, many asked for an environmental, social and governance (ESG) mutual fund that invests in real estate. So we built one, the Vert Global Sustainable Real Estate Fund, and launched it in 2017. At that time there wasn’t a dedicated ESG fund in this asset class, which is surprising, given the many compelling reasons to invest for sustainability in real estate.

At Vert Asset Management, our mission is to ‘make sustainable investing easier’. We believe investor choices help shape the world. When more assets are invested for sustainability, more companies will respond with better stewardship and responsibility. When we asked financial advisors how we could make sustainable investing easier, many asked for an environmental, social and governance (ESG) mutual fund that invests in real estate. So we built one, the Vert Global Sustainable Real Estate Fund, and launched it in 2017. At that time there wasn’t a dedicated ESG fund in this asset class, which is surprising, given the many compelling reasons to invest for sustainability in real estate.

Firstly, buildings are a big part of the sustainability challenge, and thus a huge opportunity. “The construction and operations of buildings account for 40% of global energy use, 30% of energy-related GHG emissions, approximately 12% of water use, nearly 40% of waste, and employs 10% of the workforce.” [1] We spend 90% of our time indoors. If we want a more sustainable society and economy, we need to tackle buildings.

Secondly, buildings are a fantastic Triple Bottom Line opportunity.[2] There are plenty of projects where better outcomes for People, Planet, and Profits are simultaneously achievable. Property owners can profit from energy efficiency retrofits and building improvements. Reducing energy use reduces utility bills. Better, healthier buildings typically command higher rents and are worth more.[3]

Third, investor engagement can make a big impact in the real estate sector. There are some Real Estate Investment Trusts (REITs) leading the way, demonstrating profitability through sustainability, but there are also many who haven’t been taking advantage of the opportunities yet. Investors who demand better performance, highlight best practices, and educate executives can push companies to do more and create impact.

The Triple Bottom Line Opportunity in Sustainable Buildings

Because buildings consume so many resources, and we spend so much time in them, they represent an outsized opportunity.

“The environmental impact of the built environment can be minimized with energy efficient buildings, as well as with environmentally sound siting decisions, materials selection, water use, and waste management. In addition, energy efficient buildings contribute to better indoor and outdoor air quality through reduced pollution and improved ventilation, leading to health and economic benefits.” [4] (World Resources Institute in 2017)

Making sustainable upgrades to properties old or new can be beneficial in terms of cash flow. Efficiency improvements can reduce operational costs through lower utility bills and maintenance costs; lower exposure to energy price risk; or lower insurance and debt cost. A property with a green building certification can result in higher occupancy rates or increased tenant satisfaction, which translates into longer leases, higher demand or a rent premium. Studies also show green buildings to enjoy a price premium, a lower default risk, lower volatility and slower rate of depreciation.[5]

REITs that focus on sustainability can maximize these benefits and attract ESG investors.

A Strategy for Capturing the Triple Bottom Line Opportunity

The Vert Global Sustainable Real Estate Fund owns liquid real estate through a portfolio of publicly-traded REITs. Our investment strategy is to invest in the REITs that create value with their ESG initiatives. We want to own the leading firms who are most committed to sustainability. In consultation, with leading academics, we chose the following metrics as our qualifying criteria. We believe these to be the most important, most material, and most relevant for identifying leaders.

Let’s look at some examples. First we look at two tried and true success strategies of reducing energy and emissions, and then we’ll take a look at some new and innovative ideas that are quickly gaining traction.

1) A Deep Energy Retrofit earns a green building certification, and big savings.

In 2010, the iconic New York Empire State Building underwent a retrofit[6]. Originally built in 1930, it languished in recent decades, having become expensive to operate, and unappealing to office tenants. The building has been restored to its former glory with higher occupancy, uses far less energy, and is saving lots of money, detailed below.

Empire State Building Retrofit Details

Highlights:

• Rebuilt 6,524 windows

• Reflective insulation installed

• New control systems

• Renovated HVAC system– rather than replacing with new system

Results:

• Energy reduction of 38%

• Utility bill savings of $4.4 million per year

• Payback Period of only 3.1 years

• GHG reduction of 105,000 tons over 15 yrs

– equivalent to removing 20K cars from roads

• Achieved LEED Gold Status in 2011

It is estimated that 60% of existing buildings will be renovated between now and 2030.[7] Hopefully their owners take advantage as the Empire State Realty Trust did.[8]

2) Net-Zero Housing reduces energy use and greenhouse gas emissions.

Back in 2009, Sekisui House[9], a Japanese REIT, launched their ‘Green First Zero’ homes initiative with the goal to create net-zero energy homes through sustainable design. These energy-producing and energy-saving homes reduce costs significantly for residents.

3) Health and wellness initiatives add value

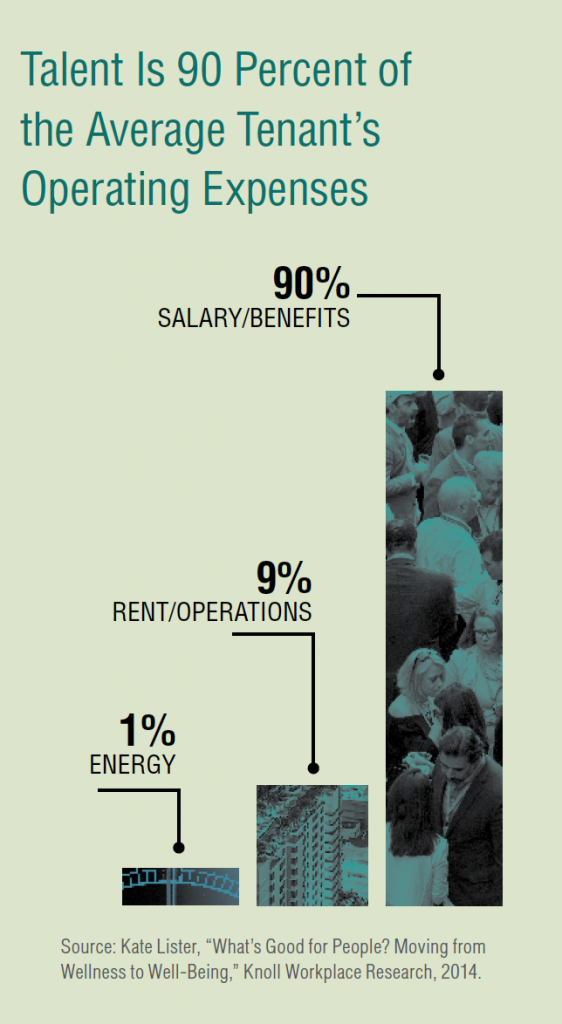

Leading REITs have long recognized the value of energy and operational efficiency; and as a result have significantly reduced their operating expenses. Now they are turning their attention to workplace health – helping tenants get more productivity from employees working in all types of buildings from offices to hospitals to warehouses.

In 2017 CoreNet Global and CBRE surveyed 211 senior executives in real estate, tech, and finance firms that had improved their workplace health and wellness design. 19 percent reported a decrease in absenteeism, 25 percent reported increased employee retention, and 47 percent reported increased employee engagement. These so-called ‘soft’ metrics can translate to ‘hard’ profits. For example, a lawyer might cost $2,500 per sick day in lost billable revenue. In a 50,000-square-foot office with 100 attorneys, one less sick day per employee per year leads to $250,000 in extra income – $5 per square foot per year. This is a huge benefit for employers and they are starting to recognize the value, and are willing to pay a premium for offices that design healthy buildings.

4) A waterfront property gets prepared for climate risk

Buildings can’t really avoid climate risk. When disaster strikes, we can often move ourselves, but we can’t move the buildings. Unfortunately, some owners underestimate the risks by relying on outdated FEMA maps or increasingly invalid ‘1 in 100 year’ heuristics. Like many coastal cities, Boston often floods during high tides and severe storms. To keep their waterfront Atlantic Wharf property safe, Boston Properties[11] installed an ‘AquaFence’ which can be deployed quickly to keep water out of the building. We prefer to hold REITs that are proactively managing climate risks.

The Engagement Opportunity

REITs own a large share of the building stock, including offices, warehouses, data centers, shopping centers, apartment buildings, hotels, healthcare, and self-storage. As an investor in REITs, we can encourage them to be more sustainable, demonstrate to other owners what works, and collaborate with a range of stakeholders to promote successful technologies and policies. It’s a great opportunity to improve the built environment so we engage with every company in our portfolio through formal letter campaigns, policy working groups, and industry events.

The REIT industry has been very welcoming to our efforts. Vert was invited to speak at the National Association of Real Estate Investment Trust’s ESG Forum the last two years. This year we presented to over 80 REITs on climate risk, how we as investors measure it, and what we want so see in terms of planning and disclosure.

Conclusion

Sustainability in the built environment is a real triple bottom line opportunity that has outsized potential for people, planet and profit. Large Institutional Investors have figured this out and many invest in green building projects directly. Vert launched the Vert Global Sustainable Real Estate Fund so financial advisors and their clients can also invest for sustainability in real estate. The more money invested on a sustainable basis, the more companies will manage their environmental and social risks and opportunities.

Article by Sam Adams, CEO and co-founder of Vert Asset Management (http://www.vertasset.com). He also chairs the Investment Research Group. Sam leads the development of new products to help make sustainable investing easier for investors. He has been a featured speaker on sustainable investing at financial advisor conferences in the US, UK, Europe, and Australia. Prior to launching Vert, Sam spent almost 20 years working at Dimensional Fund Advisors. He started Dimensional’s European Financial Advisor Services business and led it for 10 years. Sam was part of the team that created Dimensional’s first ESG strategies, the Sustainability Core funds that are offered in the US. He also led the development and launch of Dimensional’s Global Sustainability Core Fund in Europe.

Sam has a BA in Philosophy from the University of Colorado, Boulder and an MBA in Finance from the University of California, Davis. Sam is an avid mountaineer and cyclist, and is very passionate about the environment. He lives in Mill Valley, CA with his wife and three children.

Article Footnotes:

[1] Originally quoted from UN Environment Programme from Sustainable Buildings and Construction. Similar figures now found at the International Energy Agency (2019). “Energy Efficiency: Buildings.” Retrieved from: https://www.iea.org/topics/energyefficiency/buildings

[2] The ‘Triple Bottom Line’ phrase originated in 1994 with John Elkington founder of SustainAbility; most notably in the paper: Elkington, J. (1994) “Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development”, California Management Review, vol. 36, 2: 90-100. John Elkington is an Advisory Board Member of Vert Asset Management.

[3] Coleman, P., Deason, J. and Mathew, P. (2017, October). CRE Literature Survey. Presentation delivered at the Lawrence Berkeley Lab and US Department of Energy Research Workshop, University of North Carolina, Chapel Hill.

[4] World Resources Institute (2017). Accelerating Building Efficiency: Eight Actions for Urban Leaders. Retrieved from: http://publications.wri.org/buildingefficiency

[5] Fuerst, F. and McAllister, P. M. (2008, July 15) “Green Noise or Green Value? Measuring the Effects of Environmental Certification on Office Property Values.” Retrieved from https://ssrn.com/abstract=1140409

[6] Empire State Building (2014). “Sustainability & Energy Efficiency.” [Information Section]. Retrieved from www.esbnyc.com/esb-sustainability

[7] World Resources Institute (2016, May 11) “4 Surprising Ways Energy-Efficient Buildings Benefit Cities.” Retrieved from http://www.wri.org/blog/2016/05/4-surprising-ways-energy-efficient-buildings-benefit-cities

[8] Empire State Realty Trust is 0.30% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2019.

[9] Sekisui House Reit Inc is 0.31% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2019.

[10] These are the various acronyms referred to in figure 3: HEMS – Home Energy Management System, EV – Electric Vehicle, PHV – Plugin Hybrid Vehicle, PV- Photovoltaic.

[11] Boston Properties Inc. is 2.77% of the Vert Global Sustainable Real Estate Fund (VGSRX) as of March 31, 2019.

The Vert Global Sustainable Real Estate Fund’s investment objectives, risks, charges, and expenses must be considered carefully before investing. The statutory, and if available summary prospectuses contain this and other important information about the investment company and may be obtained by calling 1-844-740-VERT or visiting www.vertasset.com . Read carefully before investing.

Mutual Fund investments involve risk. Principal loss is possible. Investors should be aware of the risks involved with investing in a Fund concentrating in REITs and real estate securities, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Investments in foreign securities involve political, economic and currency risks, greater volatility and differences in accounting methods. A REIT’s share price may decline because of adverse developments affecting the real estate industry. REITs may be subject to special tax rules and may not qualify for favorable federal tax treatment which could have adverse tax consequences. The Fund’s focus on sustainability may limit the number of investment opportunities available to the Fund and at time the Fund may underperform Funds that are not subject to similar investment considerations.

The Vert Global Sustainable Real Estate Fund is distributed by Quasar Distributors, LLC.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security.