Impact Investing

IVF REIT and Rodale Institute Support Farmers Transition to Organic

Iroquois Valley Farmland REIT, an impact-driven leader in the investment and stewardship of organic, regenerative farmland, announced a new partnership with Rodale Institute, a leader in regenerative organic agriculture. Their collaboration will accelerate more US farmland to USDA Certified Organic production, by providing essential, locally-relevant support to a growing community of farmers. Read More

15 Years After its Launch, GIIN Examines the Future of a $1.5 Trillion Market

In 2009, at the Clinton Global Initiative Meeting, President Bill Clinton stood next to Amit Bouri and his founding partners as they launched the Global Impact Investing Network. The GIIN started as a 22-member community of Impact investors committed to using their investing power not only to produce financial gains, but also to produce social and environmental benefits. Read More

Carbon Clean Companies Financially Outperform Fossil Fuel and Benchmarks

As You Sow and Corporate Knights have released the latest Carbon Clean 200, a global list of publicly traded companies leading the global sustainable clean energy economy. Together, these 200 industry-leading companies generated trillions in revenue from services and products that reduce demand for fossil fuels and water, while offering investors solid returns. Read More

Women are Transforming Business and Philanthropy: CNBC Changemakers 2025

The new CNBC Changemakers list of women who are transforming business and philanthropy, recognizes leaders whose accomplishments span many fields and innovations: biotech breakthroughs, AI advances, women’s health, and new products and services, many focused on female consumers as well as tackling essential societal issues. Read More

Uncovering the Wonderful World of Fixed Income Bonds

Climate change poses significant challenges to our globalized world – the human and economic toll is already evident. The challenge for investors has always been how to navigate these risks and incorporate their analysis into the investment process. There is still no consensus on the potential impact to financial markets or how much risk is currently priced into the markets. Read More

The Power of Women and Collective Action in Investing for Change

On a backpacking trip through Sub-Saharan Africa, I saw poverty on a scale I had never seen before. That journey altered the course of my life - dedicating my career to building a more equitable and sustainable world. I also began to rethink how I invested my money. I am one of millions of women that are becoming a financial force. In fact, by 2030, women are expected to control $34 trillion, or 38%, of the wealth in the US. Read More

Investing in Diverse Founders is Good for the World and Your Portfolio

Change isn’t coming – it’s already here. Venture capital is undergoing a seismic shift, and if you’re not investing in women-led and diverse startups, consider this your wake-up call. Investors who aren’t yet looking at the untapped potential of these founders are missing out on some of the most exciting and profitable return opportunities in today’s financial markets. Read More

No Time to Waste for Women to Shape a Better World

After she had her first child and came back to work, a former colleague shared with me an interesting observation: she was getting more done at work, and with more impact. The urgent need to get home at the end of the day had sparked within her a new sharpness and focus to her workdays which has led to better relationships, greater excellence at work, and ultimately, greater positive impact on real humans.

Read More

A Community Centered Approach to Closing Credit Access Gaps: Native CDFIs

CICD is uncovering the transformative role of Native CDFIs in addressing capital and credit gaps in Indian Country. Their research reveals that proximity to communities improves credit outcomes, with character-based lending and financial counseling reducing risk and fostering success. The CDFIs drive economic transformation with culturally-tailored solutions. Read More

Breaking Barriers: Catalyzing Indigenous Entrepreneurship Toward Financial Inclusion

Indigenous entrepreneurs face systemic barriers to capital, but innovative solutions are emerging. Now, the Rooted Relative Fund and Matriarch Funds, alongside record funding for Native CDFIs in 2024, are reshaping financial systems. With catalytic capital and Indigenous-led frameworks, Native founders are empowered with funding that fosters economic mobility and self-determination. Read More

Entry Points for Equity: Risk Criteria and Partnership in Indigenous-aligned Portfolios

Incorporating Indigenous Peoples’ rights as a framework in investments mitigates material ESG risk. As demand for sustainable and right-centered business increases, Indigenous Peoples’ rights need to be integrated and amplified throughout project design to create a more just and equitable society. Read More

Indigenous Peoples and Engagement Timeline for Sustainable and Responsible Investing–2016 to 2024

This timeline includes milestones in Indigenous Peoples’ advocacy and investor engagement from 1971 through 2024. From the Standing Rock Sioux Tribe’s resistance to the Dakota Access Pipeline to the integration of Free, Prior, and Informed Consent into global corporate accountability discussions, it charts Indigenous rights in environmental justice and SRI. Read More

Indigenous Values Seed Systems Transformation in Hawai’i

Hawai‘i Investment Ready highlights the vital role of Native intermediaries in bridging cultural and financial contexts to facilitate equitable partnerships and seed scalable, place-based solutions rooted in Indigenous values. HIR empowers enterprises to address food insecurity, environmental degradation and systemic inequities. Read More

Tallgrass Institute: Connecting Investors to Indigenous Insights and Expertise

Tallgrass Institute launched in January 2025 as a Center for Indigenous Economic Stewardship. It connects Indigenous Peoples’ perspectives, solutions, and leadership with investors and the private sector and works with Indigenous organizations, sustainability professionals, and standard-setting bodies on IPs’ rights, lands, and economic priorities. Read More

Supporting Indigenous Self-Determination Through a Spectrum of Capital

The Christensen Fund is reshaping its approach to capital allocation, aligning investments with Indigenous rights and self-determination. Through initiatives like Purpose Aligned Capital, the fund supports enterprises like Tocabe Indigenous Marketplace, Akiptan Community Development Financial Institution and Navajo Power Home, driving economic independence for Native communities. Read More

Change the Lending Paradigm: A Model of Success in Native Ag Finance

Akiptan, a Native-led CDFI is revolutionizing lending for Native agriculture by prioritizing relationships, innovation and equity. Since 2019, Akiptan has provided $31 million in loans to Native producers and $1 million in grants, removing traditional financial barriers with patient capital and flat interest rates. The CDFI support’s producers with tools, resources and culturally aligned practices through Indigenous-led solutions. Read More

Small Wings, Big Impact: Revitalizing Tribal Lands and Livelihoods

The Euchee Butterfly Farm, a Native woman-owned enterprise on Muscogee Nation land, is transforming Tribal economies with sustainable butterfly farming. Its ‘Natives Raising Natives’ program trains Tribal members to farm butterflies, creating opportunities for economic independence and ecological restoration. The Tribal Alliance for Pollinators is restoring native plants for pollinators and medicinal traditions. Read More

Unleashing Potential: The Vision of WIHEDC for Native Economic Development

WIHEDC is driving Indigenous economic sovereignty by partnering with Native CDFIs to advance financial independence and homeownership across Wisconsin’s Tribal communities. Their 2024 Native Economic Impact Study revealed that Indigenous businesses and non-gaming enterprises generate significant contributions, including up to $4.83 billion in economic output when scaled statewide. Read More

2024 GreenBiz 30 Under 30 List of Sustainability Leaders

This year’s list recognizes the rising stars of sustainability for their unique and effective efforts to impact the climate crisis at scale. These are the people who are driving change at some of the world’s largest corporations like BlackRock, Estée Lauder and Whole Foods; startups such as HelloFresh and Circ, and NGOs including EDF and GRID Alternatives. They hail from the US, the UK, Mexico, Brazil and the Philippines. Read More

ASU President Michael Crow Named to TIME Climate 100

Recently, Arizona State University President Michael Crow was named to the 2024 TIME100 Climate list of leaders and innovators driving real climate action. The list includes leaders across a range of fields, from policy to business to education. TIME’s editors spent months vetting names from across the economy, prioritizing measurable, scalable achievements and recent action over commitments and announcements. Read More

Calvert Commemorates 20th Anniversary of the Calvert Women’s Principles

Calvert announces the 20th anniversary of the Calvert Women’s Principles, the first global code of corporate conduct focused exclusively on advancing, protecting, and investing in women. Developed in 2004 with the support of the UN, the Principles provide a set of standards for companies to measure progress and serve as a tangible indicator for investors to assess the evolution of gender equity at corporations. Read More

Welcome to Global Galactics and The Spark at the Center of the Universe

Sustainability is at the heart of everything we create. From the eco-friendly materials in our products to the nature-inspired themes woven into each story, Global Galactics helps children and families feel connected to our planet. We’re offering tools for self-leadership, relationship intelligence, and environmental stewardship, empowering kids to become caring stewards of their own lives and the world around them. Read More

Investing in Women in Leadership: Results Driven, Sustainable Impact Investing

In January 2023, Hypatia Capital launched the WCEO ETF investing in American public companies that have a woman CEO. The WCEO ETF, the first exchange-traded fund focused solely on public companies led by women CEOs, invests in small caps, medium caps and large caps. Our algorithm delivers the Female Factor by eliminating size and industry. Its investment thesis is that female leaders will and do outperform. Read More

Finding Resiliency Through Designing an Aligned Life

At our firm, we believe in a guiding principle: the alignment between inner values and outward actions brings a sense of personal wholeness that creates resiliency. We empower clients to make financial decisions that reflect their personal ethics, fostering a sustainable, purpose-driven world. The journey that led me to impact investment advising has been one of resilience and transformation. It started with a pivotal moment at 19 when I faced a cancer diagnosis. Read More

Investing in Gender Equality Offers a Bridge to a Healthier and More Stable Future

For impact investors, the question is not why gender equality matters — it’s how to effectively allocate capital in ways that empower women and catalyze meaningful progress. Impact investing alone cannot be a panacea for gender inequality, but it is an indispensable component of a larger solution. Gender equality can itself be an impact objective or, for portfolios targeting other impact themes, it can be one of their themes. Read More

How I Found My Way to Impact Investing & Why I Hope More Women Will Join Me

Calvert Impact is unique in a number of ways – we’re a nonprofit investment firm, we invest around the globe and across multiple sectors, we have a nearly three decades-long track record, and we have extremely accessible products with minimums as low as $20. Also, we are one of only 20% of all financial firms managed by women, and at Calvert Impact 80% of our senior leadership team are women. Read More

A History of the Women who Nurtured the Roots of CDFIs

From the 2024 Archives: Today our nation has a healthy CDFI network that makes financial services accessible and economic prosperity possible for millions. OFN, is celebrating 40 years, and its members have distributed billions of dollars, creating a million jobs and over 800,000 new businesses in addition to the housing and community services provided to millions. Read More

My Millennial Friends Aren’t Investing- But They Should Be

I’m in my early 30’s. As someone who works in finance, I know that one of the most important things I can do for myself at this point in my life is develop strong financial habits like saving, budgeting, and investing. Most of my friends work in other fields, and while the majority have a good grasp on budgeting, many aren’t saving as much as they should and even fewer are investing. Read More

Microsoft’s Climate Innovation Fund invests in Farmland LP to Support Regenerative Ag

“Farmland LP’s use of regenerative agriculture practices to ensure healthy soils, and therefore high-quality soil carbon credits, is a critical element of advancing nature-based carbon removal solutions. We’re excited to invest in their fund and work with them to create a more sustainable agriculture sector.” said Erika Basham, director of Microsoft’s Climate Innovation Fund. Read More

FLINTpro Launches Biodiversity Module on Regulatory and Financial Risk for Landowners and Investors

FLINTpro, a nature analytics firm that provides compliance and financial risk assessment products for companies regulated by land use and climate protocols, has launched its Global Biodiversity Module. It offers analysis of the potential impacts of human and industrial activities on nature and the risks associated with their dependencies on ecosystems. Read More

New Pavilion at the COP16 Biodiversity Conference on Accelerating Global Action on Sustainable Finance

The Finance for Biodiversity Foundation, UNEP FI and UNDP will host a Finance and Biodiversity Pavilion at the UN Biodiversity Conference (COP16). To meet a growing interest from the finance sector, the pavilion will serve as a central hub to discuss the alignment of financial flows with the goals and targets of the Global Biodiversity Framework. Read More

As an Investor, Why Tackle Inequality?

In this article, Rights CoLab and Oxfam America address the various risks that inequality can present for investors. Their recent report. The Investor Case for Fighting Inequality: How Inequality Harms Investors and What Investors Should Do About It, introduces the topic and outlining companies' contributions to inequality. It highlights efforts of investors that are already addressing the risks, many as part of their fiduciary duty. Read More

Sustainable Debt Market Passes $5 Trillion En Route to Record Year

A cumulative volume of $5.1 trillion in green, social, sustainability, sustainability-linked bonds, and transition bonds (collectively GSS+) has been recorded by the Climate Bonds Initiative as of June 30th of this year. Aligned with CBI’s dataset methodologies and best practice, the findings are detailed in the Sustainable Debt Market Summary H1 2024 with a breakdown of labelled bond markets. Read More

Are Your Bonds Green, Social or Sustainable? And Climate Resilient Too?

When sailing your portfolio into the future, would you want a top-heavy boat? Or a boat that is stable through the waves of future risks? “Green bonds,” “social bonds,” and “sustainability bonds” – bring comfort to impact investors. Yet, are all those bonds safe for the next 30 years? HIP has evaluated over 11K bonds that bring solutions like reducing pollution, delivering cleaner water, spurring more affordable housing, or bringing climate action forward to society as well as to your portfolio. Read More

30 Years of Impact Bonds: Q&A with Benjamin Bailey of Praxis and Cliff Feigenbaum

This year marks the 30th anniversary of the Praxis Impact Bond Fund, which gives a wide variety of investors access to a broadly diversified core bond portfolio with a focus on green, social and other types of impact bonds. Over the years, the fund’s appeal has broadened from faith-based investors to include sustainability and social-impact focused investors. Its assets have grown from $11 million in 1994 at the fund’s inception to nearly $1 billion today. Read More

Climate+Community Development: Emerging Investment Frameworks Fuel Transformative Impact

This practical article is excerpted from the book “What's Possible: Investing Now for Prosperous and Sustainable Neighborhoods,” a collaboration of Enterprise Community Partners, LISC and the New York Fed. What’s Possible offers a variety of impactful solutions for clean energy, resilience, and equity. It’s intended as a playbook for taking collective action to build a stronger and more inclusive future for all. Read More

Lifting the Lid on Impact Bonds: 5 Questions for Investors

Over the last 25 years of investing in impact bonds, we have learned the value of looking beyond labelled green, social and sustainability (GSS) bonds where investors can access a wider range of opportunities to generate positive environmental and social outcomes while pursuing attractive risk-adjusted returns. However, navigating this marketplace requires a nuanced understanding of innovative security structures, evolving standards and project-level impact assessment. Read More

Forbes Selects Green Century’s Leslie Samuelrich for Prestigious 50 Over 50 List

Ms. Samuelrich joins the ranks of venture capitalists, wealth managers, philanthropists and others on the 4th annual list that celebrates women who are pioneers in their fields, leveraging their age and experience as tools for success. The thousands of nominations were narrowed down to 200 finalists in four categories of impact, innovation, investment and lifestyle. Read More

OFN Receives Historic $2.3 Billion Grant for Clean Energy Community Investments

Opportunity Finance Network, the nation’s leading investment intermediary and network of CDFIs, will receive an award from the U.S. EPA to finance the clean energy transition in low-income and underinvested communities. The grant marks a pivotal step forward in OFN’s commitment to addressing the climate crisis, advancing environmental justice, and increasing access to capital. Read More

GoSun EV Solar Charger: The Greenest Way to Charge Electric Cars

EVs are gaining significant traction as a more sustainable and independent mode of transportation. As the demand continues to grow, so does the need for reliable and efficient charging solutions. Some have criticized that since most power plants use fossil fuels, one is simply trading emissions. However, GoSun is now providing a true solar solution with our innovative EV Solar Charger. Read More

Powering a Sustainable Future with Clean Energy Credit Union

As the impacts of climate change become more evident, the urgency to transition away from fossil fuels is clear. Investing in renewable energy is crucial for the future of our planet, yet it remains a challenge for many. The Clean Energy Credit Union focuses on making clean energy affordable and accessible to a wide range of people across the U.S. by providing an attainable entry point for individuals to invest in the clean energy movement while advancing sustainability. Read More

The Intersectional Opportunity of Solar: Addressing Climate and Inequality

The US EIA forecasts a 75% increase in solar generation from 2023 to 2025. As the solar industry races to address climate change and meet the demands from electrification and data centers, there lies opportunities to also address socioeconomic inequalities across the nation. So, we ask: Who is benefiting from the growth of the solar economy? What other community needs could this opportunity meet? Read More

Investing in an Era of Extreme Weather

Global trends can have a significant impact on a company’s financial performance. That’s why Parnassus invests in industries and companies that are positioned to remain resilient to physical climate risks. Extreme weather is occurring in different forms, posing risks to company operations, assets, workforces and long-term stock performance. While individual risks can be hard to predict, many industries are likely to be affected by extreme weather in multiple ways. Read More

Redefining How Buildings Use Energy

Over the past several decades, the energy system has steadily evolved to include more renewable energy sources. The energy supply is currently mostly fossil fuels and renewables. The fossil fuels are coal, methane, natural gas, and oil. Renewables are solar, wind, hydro, biofuels and nuclear. The biggest users of energy are transport, industry, and buildings. In fact, buildings alone consume 40% of the world’s energy. Read More

Capitalizing on New Opportunities for a Clean Grid

Our firm maintains that impact investing is synonymous with a focus on the long-term, since we believe that the businesses and industries that will drive value for investors are those that will help build a more sustainable and equitable future. Consistent with this view and an understanding that the green transition would be full of both economic and impact potential, we have tracked and selectively backed renewables-related companies and funds since our inception in 2013. Read More

Beyond 2025: Setting Credible Sustainability Goals for Long-Term Impact

BSR research on members indicated that roughly 35 percent of time-bound goals expire in 2025, and another 40 percent are pegged to 2030. As 2025 goals reach their expiration date and we evaluate progress toward those 2030 commitments, it’s time for many companies to reflect on what they’ve learned and start thinking about what’s next. Read More

Green Century’s Leslie Samuelrich Named to Prestigious Barron’s List

For the second consecutive year, Leslie Samuelrich, President of Green Century Funds, was named to the Barron’s 100 Most Influential Women in U.S. Finance, joining a corps of noteworthy women in government, technology, banking and financial powerhouses. Leslie has been a vocal and active leader, promoting environmentally and sustainable investing for the past 10 years at the helm of Green Century. Read More

Transformative 25: Catalytic Funds Raise $1 Billion for Non-extractive Finance

CAJF has released their new Transformative 25 (T25) list of impact first community informed capital funds, banks, and initiatives transforming the finance sector towards one that enriches people and the planet. T25 funds employ a mix of holistic strategies such as diverse leadership, integrated capital, creative financial tools, regenerative returns, values-aligned mission, and more to drive transformative change in finance. Read More

Pet Food and Regenerative Organic Agriculture

“We recognized the need for transparency and accountability in pet food production. We believe it is our responsibility to our pets to be good stewards of the land and replenish the soil that produces the food we eat. Our goals include rebuilding topsoil, increasing carbon capture, and growing food in the most sustainable way possible to transform the health of pets and the planet,” said John Dewberry, Cave Pets Read More

Natural Industry Growth Accelerates

“Between 2007 and 2012 we added $40 billion in consumer sales. That growth doubled to $80 billion added between 2018 and 2023. And we're anticipating continued accelerated growth for our industry as consumers increasingly of all generations demand healthier, better for you, more sustainable, more regenerative, natural, organic and conscious products,” said New Hope Network’s Carlotta Mast Read More

Funding Local Food Systems to Meet the Impacts of a Changing Climate

The resilience of our food system requires diversification, which means an emphasis on localized processing, distribution, and retail. Ag and food system lending is an area that many mainstream banks hesitate to engage in. However, more CDFIs are prioritizing investment in food systems, seeing it as core to building community resilience and meeting their mission to provide capital access to more people, businesses, and communities. Read More

Pioneers in Organic Winemaking

Frey Vineyards started as a commitment to organic Ag and winemaking when there was none. In 1980, Katrina and Jonathan Frey made their first barrel of wine. They both had become organic farmers, under Alan Chadwick's tutelage, and decided to embark on their enterprise: founding America's first organic winery. With the support of Jonathan's brother Matthew, they built the first winery, became certified organic, and started fermenting Frey wine. Pioneering the only organic winery at the time. Read More

Weather’s Impact on Investing in US Agriculture: Navigating the New Normal

From May 2024 Issue – Napa cabernet. Florida oranges. Georgia peaches. Washington apples. Why are crops so associated with places? As an investor, it's crucial to recognize the impact that weather and climate have on Ag. Weather patterns dictate the success or failure of crops, influence land management decisions, and shape the financial landscape for Ag investments. Understanding these interactions, and their changes, is critical to not only the farmer working the land, but those investing in it. Read More

Investing in Value Creation through Regenerative Agriculture

The Food and Ag industry contributes a third of global greenhouse gas emissions, and its supply chains have become increasingly vulnerable to the effects of climate change, including changing patterns of drought, precipitation, and extreme heat. So, a new approach is needed and as investors, we can influence the move away from the extractive and exploitative status quo, which has significant negative externalities, and transition to a more resilient system that can thrive over the long term. Read More

From Honest to Just: How Coca-Cola’s Fumble with Honest Tea Turned into an Unexpected Gift

Two years ago Coca-Cola told me that Honest Tea, the brand I launched, would be discontinued. Despite its success as the first organic and Fair Trade certified bottled tea brand, supply chain disruptions during the pandemic made it a victim of Coke’s new strategy. But what felt like a huge setback turned out to be a gift, and an interesting lesson in the challenges big corporations have in scaling mission-driven brands. Read More

Morningstar Launches Low Carbon Transition Leaders Indexes

This series of nine new global benchmarks, underpinned by the Sustainalytics Low Carbon Transition Ratings, will help investors target a broad range of companies that are leading their peers in their readiness for - and action towards - transitioning to a low-carbon economy. A few companies included in the indexes for leading the way in their approach to climate transition and net zero include Taiwan Semiconductor and BMW. Read More

ImpactAssets 2024 Impact Investment Fund Managers List

Now in its 13th year, the ImpactAssets 50 is the most recognized free database of impact investment fund managers. This list is a gateway into the world of impact investing for investors, financial advisors, and philanthropists. The IA 50 offers an easy way to identify experienced and emerging impact fund managers and illustrates the breadth of impact fund managers operating across geographies, sectors and asset classes. Read More

Water + Indigenous Peoples Rights = Risk

As far as life goes, priorities can’t get much bigger than Water. As far as the financial markets, Water is such a huge fundamental risk that it could cause another recession or financial crisis when we reach a tipping point. Studies have found that companies with poor Indigenous Peoples (IP) risk management also had low ESG social performance ratings and higher risk. Read More

How the Future of Water will Impact Businesses and Communities

Water is the essence of life, and yet it is almost universally taken for granted. This is at a time when we are seeing unprecedented and dire water issues globally. Water is managed as a resource (i.e., drinking water) and a waste product (i.e., stormwater) while also being managed as both a business and as a common good. Population growth and new housing development are two major issues underlying the need to find more water, yet water is often not linked to land use management. Read More

Investing in the Future of Water and Sanitation

Impact investing can transform the landscape of safe water and sanitation by addressing the complex challenges posed by the water crisis, climate change, and gender disparities. By supporting innovative household solutions and investing in climate-resilient infrastructure, impact investors can contribute to the UN SDGs and improve the well-being of communities around the world, aligning values with the potential for financial returns that helps build resilient communities. Read More

GreenMoney Interviews: Kirsten James on Ceres’ Valuing Water Finance Initiative

As the global water crisis worsens, so do financial risks facing companies and their investors. Kirsten James, senior program director of Water at the sustainability nonprofit Ceres, answers questions from Cliff Feigenbaum, GreenMoney founder about the Valuing Water Finance Initiative, which is a global, investor-led effort driving companies to prioritize water risk and act as responsible water stewards in their operations and supply chains. Read More

Praxis Mutual Funds Releases “Real Impact 2023” Report

“We work hard to provide investment options that pursue market-level returns while also aligning investors’ faith, values and investments. This report delves into many key themes for Praxis including encouraging the low carbon transition, addressing inequality, supporting low income and underserved communities, and engaging companies on good corporate governance.” said Mark Regier, VP of Stewardship Investing. Read More

Carbon Clean 200 Companies Outperform Dirty Energy

As You Sow and Corporate Knights recently released their 11th update of the Carbon Clean200™, a list of 200 publicly traded companies worldwide leading the way among global peers to a clean energy present and future. These companies generated almost double the returns of the main fossil fuel index from July 1, 2016, to January 15, 2024, despite geopolitical tensions that have favored fossil fuel stocks in the past two years. Read More

High-Powered Women to Lead Global Central Bank Forum

The 134 global members of NGFS collaborate and produce guidance on various critical topics including on supervisory practices for managing climate-related risks, design and analysis of climate scenarios and the implications of climate change for monetary policy. The collective also provides guidance for central banks on the transition to net zero and the emerging issue of nature-related financial risks. Read More

New Way of Developing Affordable Housing Through Partnerships with Churches

Churches are looking to use their real estate assets to address the growing housing affordability crisis and their own need for financial sustainability. Congregations are talking, and millions of homes are possible. New Way Homes, a non-profit that runs an impact investment fund for affordable housing development, and Workbench, a develop-design-build firm, have partnered to create a new development model. Read More

Climate-Smart Forestry: From Niche to Mainstream

EFM, the forestland investment company, I co-founded almost 20 years ago was started on the premise that commercial forests could and should be valued and managed for the full range of goods and services they produce – timber, carbon, biodiversity, water provision, recreation, scenic beauty, tribal and indigenous values, and rural livelihoods. The enduring and critical truth is healthy, intact and functioning ecosystems, particularly forests, are fundamental to the earth’s life support system. Read More

Unlocking Opportunity for Female Entrepreneurs Through Non-Traditional Financing

The UN identified the need to invest in women in two of its Sustainable Development Goals. Goal 5 (gender equality) and Goal 8 (decent work and economic growth) both pay particular attention to creating opportunity for female entrepreneurs. There is immense opportunity for sustainable investors and capital providers to meet the needs of women business owners who are in need of financing to support and grow their businesses. Read More

Making Gender Visible: A Path to Systemic Inclusion

Public equity investors have a unique opportunity to motivate companies to design for gender diversity and create genuinely inclusive systems within their organizations and throughout their value chains. Determined to equip investors with the tools to activate their voice, my financial firm developed Investor Guidance for Prioritizing Gender in 2022. The guidance supplies engaged investors with critical questions and essential tactics for motivating companies to adopt gender-specific approaches using an integrated, full value chain approach. Read More

Opportunity for Women in the Clean Energy Transition

“As we celebrate Women’s History Month, it is again a time of reflection. We delight in the pockets of progress but reiterate that there is certainly no room for complacency. The World Bank estimated that there are over 2 billion women who are without equal economic opportunity. Though in the US, numbers feel more optimistic. American women contribute more than $7 trillion to US GDP each year. In addition, they control $10 trillion in assets, a number that is expected to grow to $30 trillion over the next decade.” Read More

Calvert Impact Releases Financial Advisor Guide to Impact Investing

The impact investing market grew from $502 billion in 2018 to $1.16 trillion in 2021, yet only 56% of investors said their financial advisors asked about their impact goals. In today’s environment, talking about financial performance alone isn’t going to capture a client’s attention. This Guide is meant to help Financial Advisors leverage impact investing better, so they can seize the opportunity to support their clients in their sustainable investing journeys. Read More

What Could Shape Sustainability and Climate Investing in 2024?

In MSCI’s Sustainability and Climate Trends to Watch 2024 Report, we explore the key themes that could shape the world of ESG investing this year and beyond. Our report brings together the key questions that our global research team is asking and offers thoughtful analyses and useful insights to help navigate the investment landscape that lies ahead. This article looks at numerous impactful trends that we have identified. Read More

A Matter of Faith: Faith-based investing is a key chapter in the sustainable investing story

We begin at the Kingdom Advisors conference, with a rapidly expanding association of advisors that aims “to carry Biblical financial wisdom to their clients, peers, and community.” How large is the faith-based investment market after factoring in the assets of individuals and institutions? Find out in a recent report from Morningstar which has sized up the faith-based market including Christian and Islamic ETFs and mutual funds. Read More

Working to Ensure Justice for Workers

Faith-based investors have a long history of corporate engagements seeking to advance rights for workers in the U.S. and in global supply chains. For decades, ongoing engagements with companies in at-risk sectors including apparel and footwear, food and agriculture, and electronics have centered on the risks of human trafficking and forced labor, paying a living wage, and the need to respect unionization efforts. Read More

Seeing Healthcare as a Human Right

As responsible investors, we advocate for corporate and systemic reforms that will improve the health and well-being of all communities. For decades, faith-based investors working through the Interfaith Center on Corporate Responsibility have engaged leading pharmaceutical and healthcare companies, who must prioritize people over profits, on access and affordability of medicines, vaccines, and other health technologies. Read More

Love Your Neighbor with Your Investments

Faith-driven investing is a powerful way for investors to pursue performance and drive positive change in the world. The opportunities are vast, whether supporting companies that treat their employees fairly, contributing to their communities, or even taking steps to eliminate injustice in their supply chains. Values-aligned investors can send a resounding message about the types of business practices we will and will not stand for, shaping corporate behavior and humanity for good. Read More

Build. Give. Invest: A Framework That’s Worth the Risk

After years of working with Faith Driven Entrepreneurs and Investors around the world, I know one thing for sure: they are having incredible Kingdom impact. They are building an ethical culture and influencing their communities through their companies. Nonprofits and charities are absolutely an essential tool God uses to advance his Kingdom, but now at Faith Driven Investor we have started thinking about a threefold framework that consists of building, giving, and investing. Read More

Faith and Finance: New Horizons for 2024

What does faith have to do with capital? Given the way environmental and social uncertainties affect capital markets around the globe, quite a bit. For many, faith is required in these moments of challenge. We often think of faith institutions’ roles as leaders of moral realms, such as caring for others or honoring creation. What if we also considered the power of faith leadership paired with the capital these institutions hold. For these long-term investors, how can their faith principles be lived out through their portfolios? Read More

Guided by Wonder: A Reflection on the Stewardship of Creation

The natural environment is a finite resource, the inheritance of future generations, and a gift from God. We’re stewards of God’s Creation, not just consumers of it. Human flourishing requires thriving ecosystems. This perspective infuses our impact strategies from company engagement to impact bonds to community development investments. We’re working toward a sustainable planet where our heirs can enjoy the magnificence of Creation and businesses operate profitably without diminishing the earth. Read More

2024 Sustainability Trends: looking beyond carbon and new approaches to ESG data

New ESG and sustainability regulations, set to go into effect across the globe over the next year, will put pressure on companies to be officially transparent. And the sustainability agenda will move beyond fossil fuels to other areas such as methane emissions, addressing deforestation and increasing and protecting biodiversity. All of which, businesswise, will mean balancing short-term profits with long-term sustainability investment. Read More

Whole Foods Market Forecasts Top 10 Food Trends for 2024

Among the 10 forecasts put out by Whole Foods’ Trends Council: more plant-based offerings and a whittling down of ingredients; even cleaner “clean caffeine” products, and coffee and energy drinks with everything from mushrooms and probiotics to berries and limes; hormonal remedy products (bars, teas and “sleepy girl mocktails”) for women’s health; and products grown with regenerative agriculture—from rices to shampoos. Read More

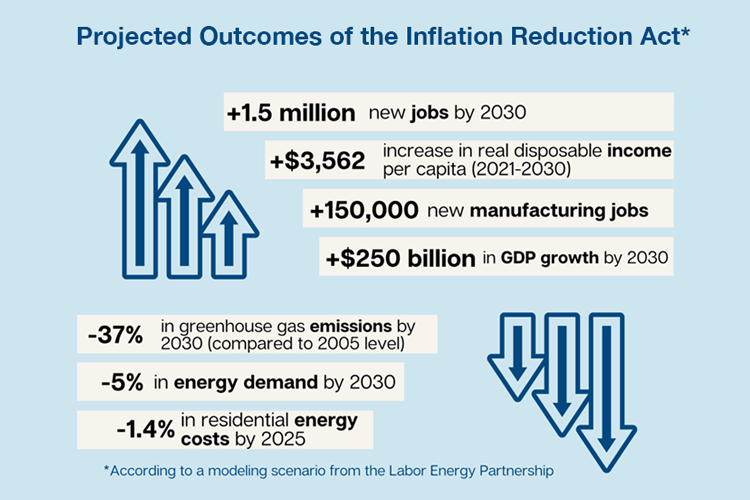

2024 Market Outlook: Forget About Predictions

What with solar and wind energy becoming such inexpensive electricity sources nowadays, and with the Inflation Reduction Act finally taking root in the business community, expect a boom in renewable energy investments. All of which will be even more possible given decreasing Fed rates and a slowdown in inflation. Read More

24 Predictions for 2024

Among the two dozen predictions and happenings from Grist for the next year: the official kickoff of the American Climate Corps, wherein 20,000 18- to 26-year-olds will spread out across the U.S. to install solar projects, mitigate wildfire risk and make homes more energy-efficient; installing a climate reparations fund at the World Bank; the spread of “greenhushing” (corporations hiding their climate commitments to avoid scrutiny); and a boom in carbon-capture technology. Read More

Strategic Intelligence Outlook: climate litigation, economic strains and more in store for 2024

Participant experts who took part in the World Economic Forum's Strategic Intelligence Outlook offered what they feel will be the trends for 2024—on everything from climate litigation and AI to disinformation and developing people’s “foresight.” One obvious and often overlooked fact: that over 50% of the world’s GDP comes from nature, and, as one attendee said, “if we start losing nature, so many businesses are dependent on it if not directly, then indirectly through their supply chains and clients.” Read More

COP28 Presidency, United Nations Climate Change and Bloomberg Philanthropies Launch New Industrial Transition Accelerator for Heavy-Emitting Industries

One concrete development to come out of the COP28 meeting in Dubai late last year was the launch of the Industrial Transition Accelerator (ITA), the world's largest industrial decarbonisation initiative to date. The ITA plans to pair up global industry leaders with policymakers, finance and technical experts. The goal being to unlock investment and rapidly scale implementation and delivery of projects needed to cut emissions and “to catalyse decarbonisation across heavy-emitting sectors, including energy, industry, and transportation, and accelerate the delivery of Paris-aligned targets.” Read More

The year ahead in ESG: assurance, transition finance and natural capital

In addition to the rise of transition financing, not only will companies now be creating and hiring ESG controllers to adhere to various climate accountability acts (like those in California and the European Union), but the TNFD will help speed up the development of the “planet economy,” according to former Microsoft chief environmental officer turned private equity investor Lucas Joppa. An economy that will provide investors with more and better tools to invest in nature—at scale. Read More

Six predictions for ESG in 2024: The year ESG emerged from fad to essential business

Just because companies worldwide have to operationalize ESG more fully in 2024, it won’t come without resistance, as it will require overhauls in everything from design processes and procurement strategies to financial management and marketing and communication practices. Transition is the keyword, as ESG evolves from “optional extras to integral elements of corporate strategy, essential for generating sustained value.” And since the release of the Task Force on Nature-related Financial Disclosures (TNFD) last September, biodiversity is going mainstream. Read More

ImpactAssets Surpasses $3B AUM, Building on Momentum in new 2023 Impact Report

ImpactAssets, the impact investing trailblazer with a decade-plus track record of mobilizing capital for good, surpassed $3B in total AUM this year, according to its 2023 Impact Report. The report also reveals that the firm directed a total of $458M in investments and $224M in grants towards funds, companies, and nonprofits advancing a more equitable, net-zero world. Read More

3BL Announces the 100 Best Corporate Citizens of 2023

Now more than ever, corporate leadership on environmental, social and governance (ESG) issues is imperative. And so is transparency. As companies decarbonize, align with the Sustainable Development Goals and rebuild an equitable economy post-pandemic, they must be open about their efforts. Each year, 3BL evaluates the largest public U.S. companies on ESG transparency and performance. Read More

Calvert Impact releases 2023 Impact Report: Demonstrate, Educate, Transform

“The theme of this year's report represents fundamental elements of our work at Calvert Impact: demonstrating that it is possible for everyday investors to use their investment portfolios to drive solutions to social and environmental challenges and educating the broader market on impact trends to ultimately transform the capital markets,” said Jennifer Pryce, Calvert Impact. Read More

Can Economists Design Hurricane Stress Tests?

Former US Treasury deputy secretary Sarah Bloom Raskin and Madison Condon of the Boston Univ. School of Law are calling for more credible public data on climate risk. Recently, Climate & Capital Media hosted a panel of experts to discuss claims that the booming private-sector climate data services industry is hyping its accuracy and failing to deliver equitable, reliable or transparent datasets. Read More

The Investor’s Role in Easing the Affordable Housing Crisis

Even in an uncertain housing market, values-based investing can play an important role in helping to solve housing affordability needs and contribute to a healthier, more stable US consumer – which is good for the economy and business. Working toward a more affordable housing market and making homeownership obtainable from one generation to the next is in the interest of our collective prosperity and worthy of the effort. Read More

A Female Perspective on Sustainable Investing

To make an impact and bring about a truly sustainable approach to investing, I needed to incorporate my personal convictions and concern for animals and the environment into my professional life. I had adopted sustainable practices in my personal life, from shopping and recycling, to using solar panels to generate electricity, but I was not using my financial expertise to generate returns for investor clients in a sustainable way. Read More

Trillium’s Advocacy Approach to Gender, Racial and Ethnic Diversity

At Trillium we believe that diversity, inclusive of gender and race, is an essential component of sound governance and is vital to a well-functioning organization. As a firm, we seek to achieve diversity at all levels and look to invest in companies that are doing the same. Studies have shown diverse Boards, C-Suites and workforces supported by an inclusive work environment lead to better business outcomes. Read More

Investing in Gender Equity is Smart Investing

Gender lens investing in the US was really an invention of the late, Linda Pei and her business partner, Leslie Christian. These pioneers launched the Women’s Equity Fund in 1993. Though the first studies linking gender diverse corporate leadership with financial results weren’t published yet, they believed that women’s contribution to the bottom line would be measurable and accretive over time. They were right. Read More

Tobacco Free Portfolios Celebrate 5th Anniv. of the Tobacco-Free Finance Pledge

Given worldwide focus on Net Zero ambitions combined with tobacco’s alarming environmental impacts, TFP encourages investors to embed ‘tobacco-free’ into Net Zero strategies. Cigarette filters are the most littered item on the planet and are a top contributor to ocean plastic waste. Tobacco production leads to deforestation and vast carbon emissions. Read More

2023 GreenBiz 30 Under 30 List of Sustainability Leaders

Decarbonizing disaster relief, supply chains and industrial chemicals. Developing whole-food snacks, circular apparel and climate-savvy financial products. Expanding pathways into climate careers for Black and Indigenous people. The honorees in our eighth year represent an array of ideas and geographies across the globe - from the UAE to the US. Read More

Catalytic Capital Success in Indian Country Shows Just and Sustainable Economic Growth through Self-Determination

Drawing from interviews with 22 practitioners comprising philanthropic investors, private investors, Native intermediaries, and Native entrepreneurs, as well as desk research and participation in Indigenous-led finance convenings, this new report demonstrates how catalytic capital in Indian Country enables long-term, culturally-aligned success. Read More

The Intersection of Buildings, Energy, and Emissions Reduction

Since buildings are responsible for around 40% of CO2 emissions as the by-product of their energy use and energy sources, they are a critical component of the efforts to reduce climate change. And, roughly 80% of the buildings you see today will still be standing in 2050. Building owners need to take action on energy efficiency and renewable energy procurement to reduce their overall emissions. Read More

The Key to a Net-Zero Future is Lower Carbon Buildings Today

While creating renewable energy is vital, we must also reduce our carbon and energy demands in order to meet our climate goals. Decarbonizing the buildings where we live, work and play is a critical piece. We hope that this call to action and aligned programs will motivate building owners, investors, and policy makers to help transform the way we build and our transition to a clean energy future. Read More

Connecting Impact Bonds and the Green Building Movement

When thinking about ways to help the planet and its people, investments in fixed income rarely come to mind - but they should. No longer are bonds just the sleepy, safe, under-attended corner of one’s portfolio. Today impact-targeted fixed income or “impact bonds” offer a rapidly expanding opportunity to directly support the type of change you are seeking in the world. Read More

Veris Wealth Publishes New Report on Investing in DEIB

“Investors have a powerful opportunity to help close the wealth gaps in the US and create a more equitable economy and society by investing in all communities. Wealth management firms can use DEIB factors in selecting asset-manager partner firms – thereby aligning their clients’ values with investments and with the management firms themselves,” said Veris CEO, Stephanie Cohn Rupp. Read More

Community Foundations and Place-based Impact Investing

Community Capital Management, a leading impact and ESG investing manager, recently released a report, Community Foundations and Place-Based Impact Investing, which takes a look at how place-based impact investments can be a great way to leverage the endowments of community foundations and donor-advised fund portfolios to align with their missions. Read More

Ten Nature-Inspired Startups Solving Environmental and Social Problems

From inventing healable composites to reduce waste, to supporting agricultural yields from the soil to the pollinators, to the creation of sustainable and safe pigments that color our world, the 2023 Ray of Hope Prize® finalists offer inspiring solutions through their use of biomimicry (also referred to as nature-inspired or bioinspired design). Read More

A Dream Team for Ocean Carbon Capture?

A group of former Google, SolarCity and Tesla executives in April snagged $20 million in what is being called the largest ocean-based carbon removal investment to date. Ebb Carbon’s technology works by speeding up the natural process of ocean alkalinization. It captures water at existing facilities and uses electrochemistry to turn them into saltwater solutions. Read More

Oceans and Climate: Investable Solutions

Ocean Exchange accelerates innovation for the blue economy as it continuously supports startups that have direct interests and impacts on our ocean’s ecosystem. OE provides support by re-distributing corporate and family philanthropy to vetted startups via a competitive process. Additionally, providing help with network introductions to partners and investors who can help advance the adoption of innovative ocean/climate solutions. Read More

Aquaculture: Bringing Climate Resilience to Maine’s Blue Economy

Maine, with nearly 3,400 miles of coastline and over 2,000 coastal islands, is inextricably tied to the sea. The Gulf of Maine has long supplied Mainers with both livelihoods and food but is one of the fastest warming bodies of water on the globe, with the average temperature rising by four degrees Fahrenheit over last four decades. The changes are extreme enough to materially affect people’s dinner plates and their jobs. Read More

The Largest Climate Catastrophe That No One Knows About

“For generations, our family has pioneered the protection and restoration of our ocean by working in education, producing documentaries and writing books. But more recently, we realize that unless society builds financial systems that incentivize positive social and environmental outcomes and the corresponding economic opportunities for people, we will never solve the mounting environmental crisis facing our planet.” Read More

How Sustainable Ocean Funds Are Navigating Impact Measurement

Blue economy funds have experienced dramatic growth in the past half decade, with nearly thirty new entrants – ten or so of them in 2022 alone. This is good news, as it signals both growing investor interest in the sector and an increasing pipeline of investable opportunities. As this ocean investment ecosystem evolves, the question of how to measure impact in investments has become a frequent topic of discussion. Read More

Proof of Peak Natural Gas but Climate Innovation Funding is Still Challenging

We’re using a record amount of electricity here on Earth but while emissions are up, the energy mix is changing significantly. Indeed, wind and solar were up 19% year-on-year from 2021, whereas coal was up just 1.1% and natural gas use actually plateaued. As a result, the energy we use now has the lowest carbon emissions ever. Read More

Sunwealth 2023 ESG Fixed Income Fund of the Year

Recently, Environmental Finance named Sunwealth’s Solar Impact Fund their 2023 ESG Fixed Income Fund of the Year. This recognition is part of Environmental Finance’s 2023 Sustainable Investment Awards – a global initiative that seeks to recognize fund and asset managers focused on ESG and sustainability. Read More

Ceres Releases Annual Climate Risk Scorecard

The new scorecard by the Ceres Accelerator for Sustainable Capital Markets shows how 10 federal financial regulators have implemented key actions to address the financial risks of climate change. There is still much more work to do addressing these risks with the same level of ambition and urgency as their global counterparts. Read More

The Climate Pricing Gap

The economic tailwinds are behind the clean energy transition. Climate change is a glaring risk on the horizon that should be impossible to ignore. But like so much of society, the stock market is stuck in Don’t Look Up mode. Asset managers can impactfully change the narrative around sustainable and climate-focused investing, while fulfilling fiduciary duty. Read More

Public Equity Investing in Renewable Energy and Energy Efficiency

Trillium’s Sustainable Opportunities thematic public equity strategy aims to address global sustainability challenges in three core areas: climate solutions, economic inclusion, and healthy living. While many of Trillium’s equity strategies have exposure to renewable energy, the Sustainable Opportunities strategy has a greater level of exposure to climate solutions, like renewable energy and energy conservation. Read More

Navigating the Investment Impact from the EPA’s Evolving Carbon Rules

For investors concerned about climate change risk, the issue of which stocks to buy, hold and sell can be quite complicated. The power sector represents the largest consumer of carbon fuels and is highly regulated. Data that measures climate risk – from sector-level analysis to security-level analysis – can be vital for investors who want exposure to the power sector while minimizing transition risk to a lower-carbon future. Read More

Clean Energy Investment and Innovation Trends: Navigating the Road Ahead

Energy transition investments globally hit $1.1 trillion in 2022, breaking the $1 trillion mark for the first time, according to BloombergNEF. And a projected $1.7 trillion will be investing globally in clean energy in 2023, significantly more than the approximately $1 trillion expected to flow into fossil fuels, according to International Energy Agency. Read More

Parnassus Removes Investment Screen for Nuclear Power

In support of the transition to a low-carbon economy, Parnassus Investments, a pioneer in responsible investing, is removing its long-held exclusion on companies that make more than 10% of their revenue from nuclear power generation and/or related activities. We believe nuclear energy offers a critical source of fuel, with benefits that include low to no emissions, safety, and stability. Read More

Soil Wealth Areas Unlock Investing in Conservation and Regenerative Ag

Croatan Institute’s recent report, Soil Wealth Areas: Place-based Financing for Conservation, Rural Communities, and Regenerative Ag, summarizes a USDA-funded, feasibility assessment regarding development of place-based financing districts in NC, CA, OR, and WI. The project engaged with 40 farms across 25K acres as well as a diverse group of partners, investors and stakeholders. Read More

Making Best Farming Practices Work for Investors

“I started Farm Holdings to restore as much land as possible and soon became obsessed with soil and soil erosion. We’re learning a lot about what you need to do to make regenerative ag work financially for investors, including partnering with farmers and ranchers around the collocation of clean energy with regenerative ag,” said Tim Luckow, founder Read More

The Untapped Climate Opportunity in Alternative Proteins

By investing in the development and scaling of alternative proteins, we could reduce GHG emissions, create economic opportunities, and contribute to sustainable development. In addition to the environmental benefits, they offer other potential advantages. Plant-based proteins can be produced with significantly less land, water, and other resources than traditional animal agriculture as well as improve animal welfare. Read More

Climate Risks Threaten Investor Appetite for Intensive Livestock Production

Global meat consumption is expected to grow over the next decade. The changing global climate poses significant risks not just to the growth, but to the fundamentals of the industry. From the rising price of feed to desertification of grazing lands and increasing regulation to reduce GHG emissions, climate-related risks require an extra layer of analysis for asset allocation in the sector. Read More

Three Trends Driving the Growth of Organic Agriculture

2022 was a breakout year for organic agriculture. Consumer demand for organic food continued its steady rise, with strong prices for producers, rising land values and excellent returns for investors. Beyond these results, three significant trends were sharply apparent last year that will continue to affect not only organic farming but the entire agriculture sector including investor interest in sustainable farmland practices. Read More

Public Equity Investing in Sustainable Food and Agriculture

Trillium’s Sustainable Opportunities thematic suite of public equity strategies aims to address global sustainability challenges in three core areas: climate solutions, economic inclusion, and healthy living. As an intersecting theme, sustainable food and agriculture, cuts across these issues. Since 2008, Trillium has identified companies benefiting from the shift to a more sustainable economy. Read More

Calamos Launches New Sustainable Equity Funds

John Koudounis of Calamos Investments and NBA superstar Giannis Antetokounmpo share the goals of economic empowerment, financial education, and giving back, especially to young people in the community.

So together they are creating sustainable funds and ETFs designed to generate investment and societal returns, based on ESG research and investment principles. Read More

Praxis Funds Releases 2022 Real Impact Report

Praxis Mutual Funds, a leading faith-based, socially responsible family of mutual funds from Everence Financial has released its 2022 Real Impact Report. The third annual report shares specific real-world impacts arising from the Praxis team’s work to fulfill its stewardship investing mission. Key themes include supporting the low carbon transition, protecting human rights and addressing inequality. Read More

Domini Impact Investments Releases 2022 Impact Report

Domini’s new report underscores how their impact investment standards, in-house research, and corporate engagement helped to address some of most pressing issues. “Encouraging companies to deepen their sustainability efforts was a focus of our work in 2022. We leveraged it to support the climate transition, safeguard nature, and promote equity,” said Domini CEO Carole Laible. Read More

New Toolkit Guides Investors on Indigenous Rights Respect

Recently Amazon Watch published Respecting Indigenous Rights: An Actionable Toolkit for Institutional Investors. The Indigenous-led guide for pension funds, asset managers, and other institutional investors looks at the responsibility to respect the rights of Indigenous peoples which is crucial for climate stability, biodiversity protection, and financial risk management. Read More

Green Century Funds President Named to Prestigious Barron’s List

Leslie Samuelrich, President of Green Century Funds, was named to the new list of Barron’s 100 Most Influential Women in U.S. Finance, joining the ranks of prominent women including Treasury Secretary Janet Yellen and other notable names in finance. Samuelrich has been an articulate and powerful voice in promoting SRI for the past 10 years. Read More

Native Americans Get Funding for Climate Projects

The recent U.S. IRA directs $720 million to tribes and Native communities for climate resilience and solutions. From gold rushes to oil booms, Native American lands have been subjected to some of the worst environmental abuses in America including unregulated mineral mining, rapacious fossil fuel extraction, and multiple pipelines. Read More

Sustainable Land Trust Management

Are you involved with your local Land Trust? If the answer is “Yes, I go hiking on the local trails,” you are not alone. There are currently more than 1,700 Land Trusts including 467 accredited Land Trusts in the U.S. When you are called on to make a donation or to join the staff or board, this will help give you some insight into the current and rapidly changing landscape of finance for community protected areas. Read More

Carbon Clean 200 Companies Outperform Dirty Energy

“The Clean200 has demonstrated consistently that what we called the ‘clean energy’ future seven years ago is now the clean energy present. This year, the scale and global diversity of leading companies continue to expand and redefine the term cleantech to be any company that has products and services that will reduce demand for fossil fuels and water” said Andrew Behar, CEO of As You Sow and report co-author. Read More

State of Green Business 2023 and the Top 10 Trends

In the 16th annual edition of the State of Green Business, the GreenBiz editors and analysts have selected 10 key trends worth watching, reflecting a broad spectrum of environmental and sustainability topics: transportation, carbon removal, the circular economy, climate tech, sustainable food systems, renewable energy and more. Also find the state of biodiversity, and insights on green jobs and careers. Read More

ImpactAssets 2023 Impact Investment Fund Managers List

ImpactAssets has released its twelfth annual IA 50 List, a free database for impact investors, family offices, corporate and family foundations and institutional investors that features a diversified listing of private capital fund managers delivering social and environmental impact as well as financial returns. This year’s list includes Emerging Impact Managers and Emeritus Impact Managers. Read More

Inclusive Gender and Climate Finance – 2X Global Report

Investing at the nexus of gender and climate finance has been evolving in recent years: from the development of new research and case studies that help make the case for this approach and illustrate its benefits, to the emergence of tools to support investors in adopting an integrated approach. This new report is for both investors and investment intermediaries. Read More

US SIF: Forum for Sustainable and Responsible Investment names Maria Lettini new CEO

“US SIF has accomplished so much and is poised to accelerate its impact and accomplishments. This is an incredible opportunity to apply my experience from FAIRR and PRI to the US sustainable investment market and to help drive the mission and impact of US SIF to the next level” said Maria Lettini. Read More

Carbon Equity Wants Climate Investments to Pack a Punch

If you’re an investor looking to support solutions to climate change, how do you know your money can make an actual impact? Here are a few answers. As CEO and co-founder of Carbon Equity, Jacqueline has leveraged her experience as a private equity investor and company builder to create an organization that directs capital to climate funds. Read More

2023 CDFI Sustainable Investing Trends

Sustainable investing has gained momentum over the past decade with both financial professionals and casual investors. Growing social, economic, and environmental concerns have fueled an increase in socially responsible investments, and CDFIs are critical players, leveraging specialized knowledge and resources to create innovative financial products with a positive social return. Here are key CDFI investing trends. Read More

Three Ways Financial Advisors Can Advance Racial and Gender Equity

An analysis by McKinsey found closing the racial wealth gap would add up to $1.5 trillion in economic activity over the next 10 years through job creation and income gains. This article looks at the benefits of moving low-cost capital to depositories advancing access to capital for minority and women-owned businesses as well as access to homeownership to build wealth. Read More

Celebrating Women and Investing

In honor of Women’s History Month, Stella Tai, Stewardship Investing Impact and Analysis Manager at Praxis Mutual Funds interviews Lori Scott, Managing Director of Impact Credit at Lafayette Square to reflect on the contributions and achievements of women in the field of investing. Lori brings 25 years of experience in community development finance and has paved her own way in the impact investment field. Read More

The Benefits of Putting our Feminism into our Finances

From the April 2023 Archive - Investing with a Gender Lens is not new. Many of us have been at this for a while now. And yet 2023 is the year we stand to make significant progress in bringing more balance to both our finances and to corporate America and beyond. Gender Lens Investing is an approach to investment due diligence that seeks to incorporate gender considerations into investment decision-making. Read More

Innovative Use of Farmed Oysters Boosts Businesses and the Environment

Oyster aquaculture and restoration program celebrates successes, looks to the future – When the COVID-19 outbreak shuttered restaurants throughout the country, commercial oyster growers saw their sales plummet. At the same time, the pandemic forced many organizations that were restoring native oyster reefs to suspend their work. During this challenging period, The Pew Charitable Trusts’ conserving marine life in the U.S. project and The Nature Conservancy recognized an opportunity to connect the two groups through an effort that we named Supporting Oyster Aquaculture and Restoration (SOAR). Read More

Brands Grapple with Sustainable Growth in Crowded, Stalling, Alternative-Protein Market

Industry players must keep making their products even more attractive, appeal to older generations and bring down costs. Only then can we address the significant environmental impacts of animal agriculture while satisfying the meat-loving masses. The environmental benefits of having a hefty proportion of the global population moving to a meat-free diet are well documented. Animal farming uses around 77 percent of the world’s agricultural land; yet, it only supplies 17 percent of our food. It is this inefficiency that continues to drive the expansion of farms, and ongoing deforestation and loss of ecosystems. Read More

Mad Capital Closes $4m Seed Round to Finance Regenerative Agriculture

Mad Capital, an impact-focused lender offering funding for organic and transitioning farmers, announced that they've raised a $4M seed round, led by Trailhead Capital. "Regenerative agriculture aspires to work with nature, rather than against it. Our goal is to finance 10 million acres of farmland by 2032." said co-founder, Phil Taylor. Conventional industrial agriculture is responsible for the ongoing degradation of our soil, greenhouse gas emissions, biodiversity loss, and chemical laden foods. Regenerative farming is a rising movement that addresses these challenges. However, many farmers struggle to convert to regenerative because traditional banks are largely unwilling to supply transition financing. Read More

REI will ban ‘forever chemicals’ from clothes and cookware in 2024

After more than a year of pressure from environmental groups, the major outdoor retailer REI announced February 21, that it will ban hazardous “forever chemicals” from its clothing and cookware by fall 2024. REI’s new product standards will require its suppliers to eliminate all per- and polyfluoroalkyl substances, or PFAS, from the pots, pans, apparel, shoes, bags, packs, and similar gear sold by the retail chain. Suppliers of heavy-duty apparel like professional-grade raincoats will have until 2026 to make those products PFAS-free. Read More

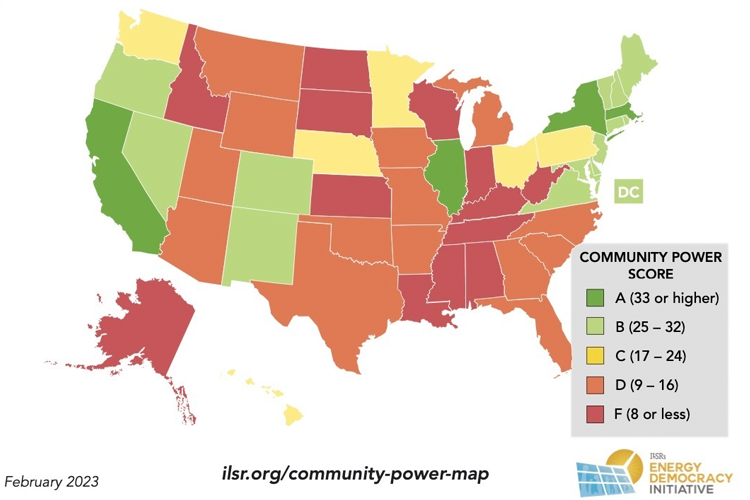

The 2023 Community Power Scorecard

Each year, the Institute for Local Self-Reliance tracks and scores states based on how their policies help or hinder local clean energy action. The states that score the highest let communities take charge and build the energy future that best suits local needs. In the 2023 Scorecard, 4 states excelled, 14 states and the District of Columbia saw above average scores, 6 were average, and 13 states received failing grades. Read More

Ann Arbor’s big decarbonization bet

Cities + Solutions series: Ann Arbor, Michigan which, like many other cities, has set ambitious emissions targets. Unlike most other cities, it’s piloting plans in one of its lowest-income communities. “We made a really strategic decision to focus on those who have been hurt first and worst by climate change and systemic racism.” – Missy Stults, Ann Arbor Sustainability Director. Read More

What You Should Know About Soaring Egg Prices

Egg prices are in the news and hitting budgets hard. Two main factors led to higher egg prices, but there may be a bit of relief coming. Through November 2022, egg prices jumped 49%, according to the Bureau of Labor Statistics. If you’ve checked the grocery store, the price of a dozen eggs varies but you may see prices closing in on $10. You can also find organic eggs at a lower price point than conventional. Read More

EPA Launches $550 Million Program for Environmental Justice Grants

In August of 2022, President Biden signed the Inflation Reduction Act into law, creating the largest investment in environmental and climate justice in U.S. history. Now, the Biden-Harris Administration announced the availability of $550 million from the Inflation Reduction Act for the EPA's new Environmental Justice Thriving Communities Grantmaking program which will fund up to 11 grantmakers for community-based projects that reduce pollution. Read More

World’s biggest investment fund warns directors to tackle climate crisis or face sack

Norway’s sovereign wealth fund, the world’s single largest investor, has warned company directors it will vote against their re-election to the board if they do not up their game on tackling the climate crisis. Carine Smith Ihenacho, the chief governance and compliance officer of Norges Bank Investment Mgmt. said “the fund was preparing to vote against the re-election of at least 80 company boards for failing to set or hit environmental or social targets.” Read More

At Columbia’s $600 Million Business School, Time to Rethink Capitalism

On the Manhattanville campus, the architecture of Diller Scofidio + Renfro reinforces a social movement in business education to do good as well as make money. The design of the campus coincided with business schools around the country coming to terms with rising criticism that companies are too predatory, exploitative and monopolistic, and that business education had to change. Read More

2022 Trends in Purpose and What They Mean for the Year Ahead

Purpose-driven marketing and ESG stakeholder relationships have seen escalating through the pandemic — with increased challenges and opportunities. In 2022, we saw brands double-down on purpose-driven initiatives as they worked to drive consumer loyalty, retain top talent and create exponential impact — all amidst a rise in consumer skepticism and politically motivated attacks on ESG. Read More

New Year, New Glass Heights: Women Now Comprise 10% Of Top U.S. Corporation CEOs

January 1st was the start date of five new women helming Fortune 500 companies, bringing the total number of female CEOs to 53. Which means, for the first time—after years of being stuck at the 8% mark—over 10% of Fortune 500 CEOs are women. Let's take a moment to recognize how far we've come by celebrating some of the history-making women who brought us over the 10% line. Read More

How Pittsburgh found a secret climate weapon in ‘the thrilling world of municipal budgeting’

Pittsburgh’s goal: a zero-carbon budget. An ambitious plan adopted in 2018 with objectives like 100 percent renewable energy by 2030, a fossil-free fleet and zero-waste. There are several ways a city can slice its budget. One is incremental budgeting, wherein the previous year’s budget provides the baseline for the next. Priority-based budgeting maps every dollar a city spends to a specific program. Read More

Hypatia Announces Launch of Exchange Traded Fund – Hypatia Women CEO ETF

On January 9, Hypatia Capital Management LLC announced the launch of a new exchange traded fund, the Hypatia Women CEO ETF (NYSE: WCEO), which invests in large women-led companies. "We believe investors are increasingly interested in the research that highlights the performance of female leadership” said Patricia Lizarraga, founder and managing partner. Read More

Natural capital earns investor interest

Institutional investors across the globe are taking stock of natural capital — the value extracted from soil, air, water, climate and all the living things and ecosystem services that make the economy possible. Examples include advancing sustainable hydroponics, beef alternatives, biodegradable consumer products and degraded land restoration. Read More

Six ESG and Climate Trends to Watch for 2023

In MSCI’s ESG and Climate Trends to Watch for 2023 we discuss the key topics investors face, from climate change, the environment and the road to net-zero, through to regulatory requirements, supply chain innovations, biodiversity and new technologies, as well as issues affecting everyday life. Read More

How vulnerable is Wall Street to climate change? The Fed wants to find out.

Major disasters like hurricanes and wildfires can wipe out buildings and crops, causing losses for the banks that make loans against these assets. On January 17th the Federal Reserve released new climate risk analysis details it’s asking six major U.S. banks to conduct, to assess just how vulnerable big banks are to this kind of upheaval. Read More

Wall Street’s New ESG Money-Maker Promises Nature Conservation—With a Catch

Big global banks are eyeing some of the world’s most fragile countries for a new experiment in financial engineering: debt relief in exchange for environmental protections. As much as $2 trillion of developing country debt may be eligible. Ecuador is said to be working on a $800 million transaction and Sri Lanka is considering a $1 billion deal. Read More

Upcoming Regulations in ESG Ratings: Three Implications for Business

The field of ESG ratings is in a phase of rapid growth—it is estimated that there are 150 different ESG data providers in the market, and these figures are expected to grow. The estimated scale of ESG-related assets under management (AUM) is predicted to reach US$53 trillion by 2025, equivalent to a third of all global investments. Read More

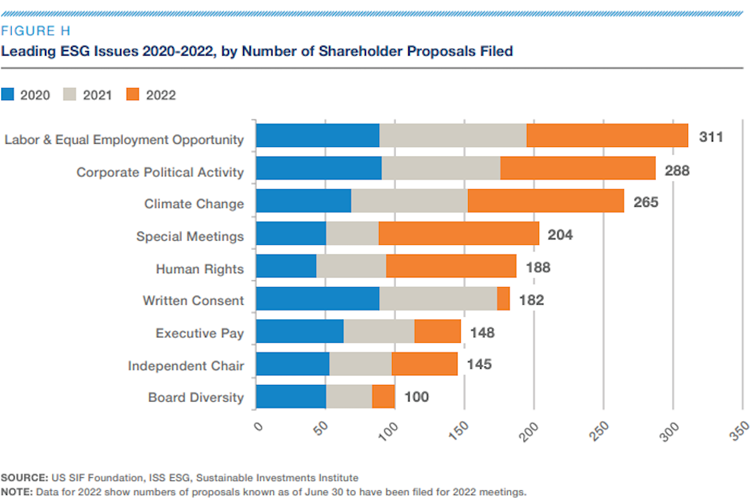

Sustainable and ESG Investors Advocacy

According to the 2022 Trends Report, from 2020 through the first half of 2022, 154 institutional investors and 70 investment managers collectively controlling nearly $3.0 trillion in assets at the start of 2022 filed or co-filed shareholder resolutions on environmental, social or governance (ESG) issues. Investors also focused on disclosure and management of corporate political spending and lobbying. Read More

ESG Incorporation by Institutional Investors

The US SIF Foundation using a new modified methodology for their 2022 Trends Report identified 497 institutional asset owners applying ESG incorporation practices across $6.6 trillion in assets under management. The group included institutional asset owners and plan sponsors such as public funds, insurance co, educational and faith-based institutions, foundations, labor funds, hospitals, and family offices. Read More

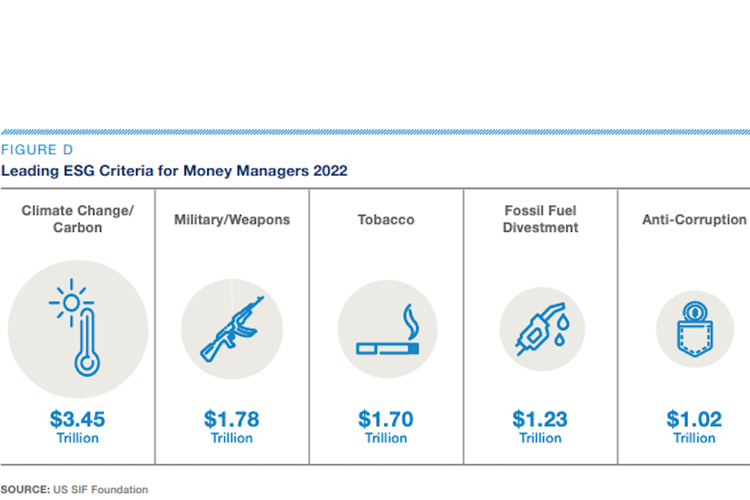

ESG Incorporation by Money Managers

Using the US SIF Foundation’s new modified methodology, the 2022 Report on US Sustainable Investing Trends identified 349 money managers and 1,359 community investment institutions incorporating Environmental, Social and Governance (ESG) criteria into their investment decision-making processes across a total of $5.6 trillion in assets under management (AUM). Read More

2022 Report on US Sustainable Investing Trends: Executive Summary